Hope rises for low-income retirees, as FG injects N107bn into pension protection fund

Kindly leave a comment and share

Chuks Udo Okonta with agency report

The Federal Government has allocated N107 billion to the Pension Protection Fund (PPF) in a bid to safeguard the financial security of low-income retirees under the Contributory Pension Scheme (CPS), the National Pension Commission (PenCom) has said.

The fund is part of the N758 billion bond approved by the Federal Government to clear outstanding liabilities under the Contributory Pension Scheme while enhancing retirement benefits for vulnerable pensioners.

Recall that PenCom had recently granted an approval for retirees whose monthly/quarterly pensions are less than N23,333.33, representing one-third of the current minimum wage of N70,000.00, an opportunity to choose between receiving the outstanding balance in their RSAs en bloc or continuing to receive their current monthly/quarterly pensions pending the commencement of the Minimum Pension Guarantee.

The Director General of the National Pension Commission (PenCom), Omolola Oloworaran, according to Premium Times, disclosed this at a press conference in Abuja on Thursday after the Quarterly PenCom/Operators Consultative Forum.

According to her, including the PPF in the settlement plan reflects the administration’s recognition of the economic difficulties pensioners face on the lower end of the earnings scale.

“This is a major step towards ensuring that pensioners—particularly low-income earners—receive a living wage in retirement.

“With this intervention, the government is addressing long-standing funding gaps and reinforcing the sustainability of the pension system,” she submitted.

The PPF was established under the Pension Reform Act 2014 to provide financial assistance to pensioners with low balances in their Retirement Savings Accounts (RSAs). However, its implementation has remained largely ineffective due to a lack of funding.

This injection of funds is expected to provide much-needed relief to retirees who struggle with the rising cost of living.

Beyond the PPF, the N758 billion bond also covers N253 billion in accrued pension rights for retirees from treasury-funded Ministries, Departments, and Agencies (MDAs), as well as N388 billion to clear outstanding pension increases dating back to 2007.

“Pension Increases Since 2007 – N388bn has been provided to clear pension increases that have remained unpaid for nearly two decades. This long-overdue entitlement, benefiting over 250,000 retirees, reflects the administration’s commitment to ensuring pensions remain fair and responsive to economic realities,” she said.

An additional N11 billion has been earmarked to ensure university professors receive full retirement benefits.

The bond issuance follows persistent complaints from pensioners over delayed and inadequate payments, with many retirees falling into financial distress.

Under the new framework, the government has pledged to ensure that accrued pension rights are incorporated into the monthly personnel cost general warrant, guaranteeing timely disbursement going forward.

The intervention also comes when Nigeria is grappling with high inflation and a depreciating naira, which have significantly eroded the purchasing power of pensioners.

Ms. Oloworaran commended President Bola Ahmed Tinubu for what she described as a decisive intervention in pension administration. She also acknowledged the role of the Minister of Finance, Wale Edun, in facilitating the funding arrangement.

“This resolution of pension liabilities restores confidence in the CPS and positions the pension industry for long-term growth. Beyond immediate payments to retirees, it will stimulate the economy, deepen the capital market, and enhance overall financial stability.

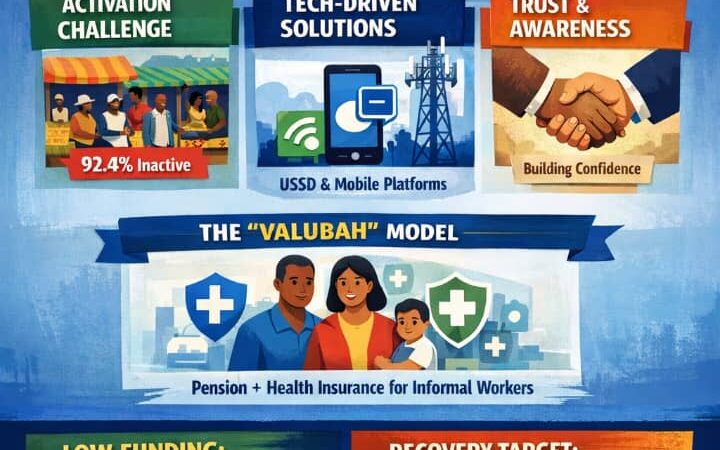

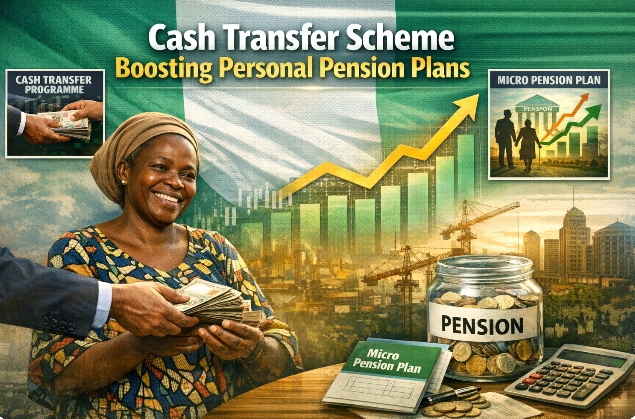

“With this burden lifted, the pension industry can now focus on innovation, improved service delivery, and optimising investment returns. A renewed emphasis will also be placed on expanding the Micro Pension Plan, ensuring that Nigerians in the informal sector can save securely for their future,” she said.

The federal government led by President Tinubu and the Minster oi finance Wale Edun indeed deserve commendation for facilitating funding arrangements for the payment of accrued pension rights and pension increases.

However I hope PENCOM and PFAS will not hide under any law to deduct a dime from public contributory pensioners in the payment of pension increases.

When PTAD paid DBS retirees pension increases they were paid fully and transparently without deductions (except union dues) same also should apply for contributory retirees, please.