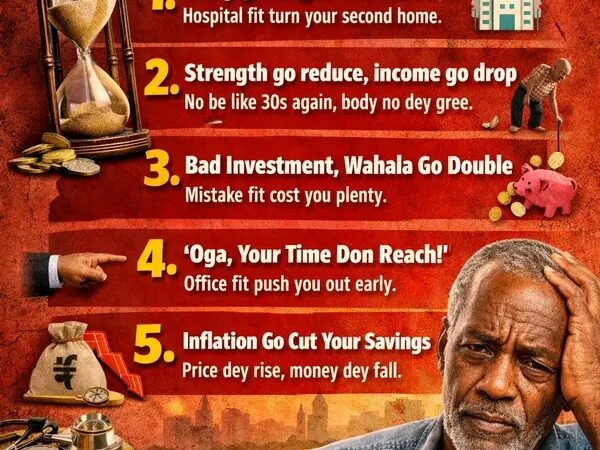

Don’t allow employers ruin your retirement, buy deferred annuity

Kindly leave a comment and share

Chuks Udo Okonta

The economic headwinds would have forced many employers into struggling with contributing and remitting their employees’ pension.

This poses a great threat to a comfortable retirement lifestyle for hardworking employees, even as the National Pension Commission PenCom) is hitting hard on defaulting employers, to ensure they meet the statutory contributions and remittance of employees’ pension.

Amid the engagement between defaulting employers and PenCom, wise employees should focus their attention on deferred annuity as a means to personal plan for a comfortable retirement.

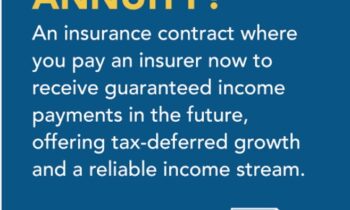

Deferred annuity is a retirement product offered by life insurance companies, which provides a simple and flexible means for people to save towards retirement.

The annuity product offers contributors an opportunity to make contributions according to their income on a monthly, quarterly or annual bases.

Benefits of deferred annuity

*Guaranteed income

An annuity contract guarantees a steady income stream in retirement, as long as you follow the contract conditions. This can help you plan for retirement more predictably.

*Tax-deferred growth

Your money grows tax-free until you start withdrawing it, which can help your money grow more effectively.

*Flexibility

You can choose when to start receiving payouts, and how long they last. This can be useful if you’re also receiving income from other retirement sources.

*Protection against market volatility

Fixed deferred annuities offer a somewhat guaranteed return, which can help protect your savings from market fluctuations.

*Potential tax advantages

There are usually no limits on how much you can pay into an annuity, unlike retirement accounts.

*Death benefit

Some plans offer a payout to your beneficiary if you pass away before the annuity starts paying out.

*Payout options

You can choose from a variety of payout options, including a lump sum payment, a lifetime payout, or a fixed-period payout.

*Surrender value

You can decide to terminate the contract in line with the terms and conditions stated in the policy. The insurer would then work out and pay your benefits.

*No will, letter of administration required

Unlike other saving portfolios that required a will or letter of administration from next-of-kin to access benefits, deferred annuity does not demand such documents. Payments are make to beneficiaries stated in the policy documents.

*Free life cover

At maturity, if the deferred annuity fund is converted to retiree life annuity, there is a death benefit of a multiple of five times annual earnings payable to your preferred beneficiaries.

Employees should stop wailing over their employers non contributions and remittance, embrace deferred annuity, while PenCom tackles their defaulting employers.