CIIN Insurance Ambassador takes awareness to Lagos State University

Kindly leave a comment and share

Chuks Udo Okonta

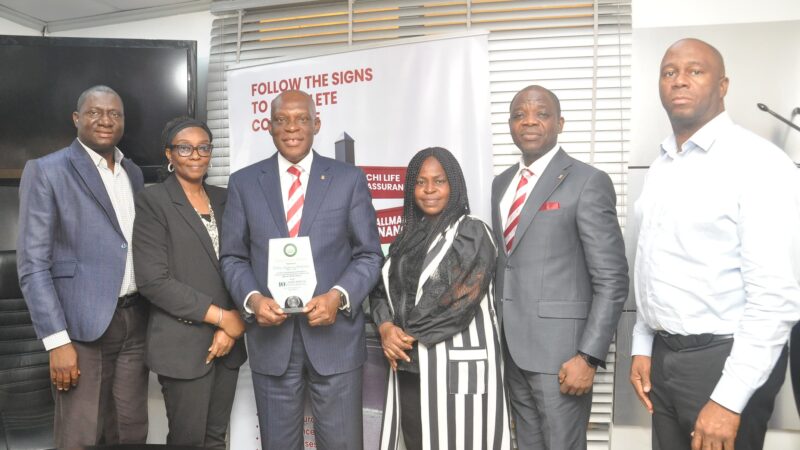

The Chartered Insurance Institute of Nigeria (CIIN), promoting its Ambassador’s Project on Insurance Awareness, today organised an education and enlightenment program for students of Lagos State University.

The initiative which was held in partnership with the Department of Insurance Lagos State University, brought together top insurance executives; lecturers in the department and students.

The event which held at LASU’s Aderemi Makanjuola Hall in the School, focused on the theme “Bridging The Gap Through Innovation And AI” and featured prominent figures such as CIIN Registrar, Abimbola Tiamiyu, the Head, Strategy and Corporate Planning Sovereign Trust Insurance Plc, Mensah Simon Peter, the Head of Department of Insurance, Dr Ajemunigbohun Sunday, Managing Director Consolidated Hallmark Insurance Limited, Mrs. Mary Adeyanju; Insurance Ambassador Akorede Johnson; amongst other dignitaries.

The initiative aims to enhance understanding of insurance concepts and promote innovation within the insurance students and the industry, reflecting a commitment to developing a more informed public and fostering professional growth among students and practitioners alike.

Speaking at the event the Managing Director Sovereign Trust Insurance Plc Olaotan Soyinka, represented by an Executive of Sovereign Trust Insurance Plc, Mr. Dayo Amusa,emphasised the importance of effectively communicating the principles of insurance to address public misconceptions.

Soyinka underscored that insurance operates as a collective investment scheme, leveraging the fact that not everyone will claim simultaneously, noting that this ensures that contributions support those in need during claims.

He noted that to combat biases and enhance customer trust, innovations like “living benefits” in life insurance have been introduced, offering tangible value even without claims, stressing that the focus now shifts to crafting simplified, relatable messages that resonate with diverse audiences, leveraging digital platforms and tailored communication strategies to foster understanding and engagement.

“How do we ensure that in our communication people are not feeling low, shifted, and one of the things we try to do to remove that bias remorse support is to introduce living benefits, for instance, in the area of life insurance for health insurance, not so far, because usually may be right, but with life for instance, we have done things like introducing some of them like I said, you guys are innovators.

“So the question goes back to you as to, how can I ask this message today in a way that you would understand,” he submitted.

In his remark, the Head, Strategy and Corporate Planning Sovereign Trust Insurance Plc, Peter Amedu emphasised that Artificial intelligence is set to transform the insurance sector by streamlining operations, enhancing customer experiences, and improving risk predictions.

However, he noted that the industry’s inherent risk-averse nature poses challenges to rapid adoption of this cutting-edge technology, stressing that many insurers are adopting a cautious “wait-and-see” approach, delaying the integration of AI despite its potential benefits.

“Consider a scenario where an employee has just experienced a work injury. An AI-powered claims assistant guides them through the process, analysing photos of the injury, cross-referencing policy details and even scheduling a medical appointment, all within minutes. By handling these routine tasks, AI frees human agents to build meaningful relationships.

“Risk assessment, the cornerstone of the industry, also stands to be transformed. Machine learning algorithms can analyse vast datasets, uncovering patterns and insights that might elude the most experienced actuaries. Generative AI will further harness unstructured data, including as much as 80% of all available information in insurance companies.

“By leveraging these underused insights, insurers can create comprehensive, 360-degree views of the insured. This deeper understanding leads to more accurate and personalized risk profiles, significantly enhancing the quality of underwriting decisions and claims assessment,” he added.

The President of CIIN Mrs. Yetunde Ilori, represented by the Registrar Mrs Abimbola Tiamiyu, urged the students to cultivate the spirit of insurance, stressing that insurance remains one of the best ways to stay above risks.

She appreciated the management of the University, especially those of insurance department for their contributions to insurance sector growth.

Managing Director Consolidated Hallmark Insurance Limited, Mrs. Mary Adeyanju, who is also a council member of the institute, implored the student to bring the needed innovation in the insurance sector.