Insurance sector assets soar to N3.88tn, as operators pay N564.1bn claims in Q3 2024

Kindly leave a comment and share

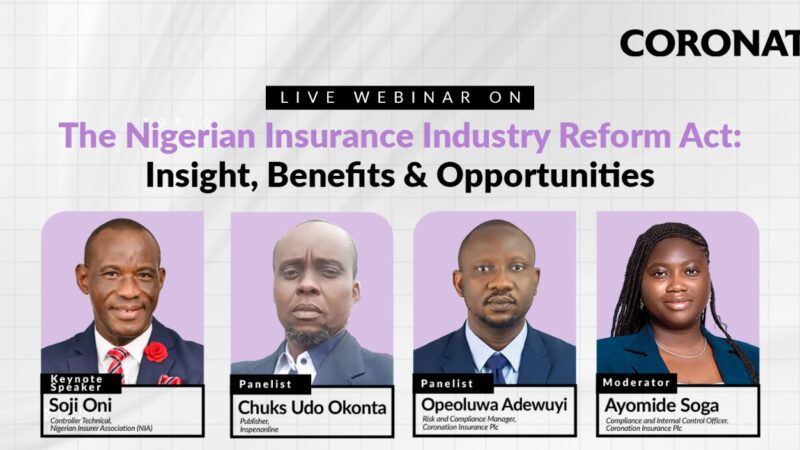

Chuks Udo Okonta

The insurance industry in the third quarter of 2024, recorded a N3.88 trillion in total assets representing an expansion of 5.1 per cent compared to the corresponding period when it reported N2.81 trillion as the industry size, the National Insurance Commission (NAICOM), has said.

NAICOM stated this in the Synopsis of the Insurance Market in Third Quarter 2024, that was obtained by Inspenonline. It noted that the statistics of the financial position of the market also recorded a total of N2.34 trillion in assets as attributable to Non-Life business, while the Life business accounted for N1.54 trillion as total assets at the close of the quarter.

The insurance industry regulator submitted that the sector showed resilience amid macroeconomic

challenges, sustaining the industry growth trajectory at 60.9 per cent, year on year, and 44.3 per cent on a quarter-on-quarter basis, to close at about N1.17 trillion in gross premium

written.

“The Gross premium written in the third quarter of 2024 stood at N1.17 trillion a remarkable occasion attributable to the consistent deepening policy of the Commission and market resilience.

“The performance was majorly led by the non-life sector, recording a market share of 68.9 per cent for a total volume of N808.4billion while the life segment accounted for 31.1 per cent of the market premium aggregate,” it posited.

On claims payment, it maintained that the improvements in claims management of the industry has served as driver for expansion in gross claims reported in Q3 2024, reaching N564.1 billion which is representative of about 48.1 per cent of the total premiums generated during the period.

This, it said however underscores the need for accelerated premium growth and appropriate rate setting.

According to NAICOM, the Life Insurance segment recorded an impressive claims settlement ratio of 81.6 per cent, while the Non-Life segment achieved

73.6 per cent.

It noted that the ratio of net claims paid demonstrated strong performance across various business classes, adding that

motor insurance achieved an outstanding ratio of 92.3 per cent; followed by miscellaneous at 88.9 per cent;

general accident and fire businesses recorded 86.3 per cent and 75.1 per cent respectively.

It said the oil & gas business, while lower at 63.7 per cent, showed significant progress compared to 43.1 per cent recorded in the corresponding period of the previous year.