91.88m Nigeria’s informal-sector workforce lack personal pension plan – PenCom

Kindly leave a comment and share

Chuks Udo Okonta

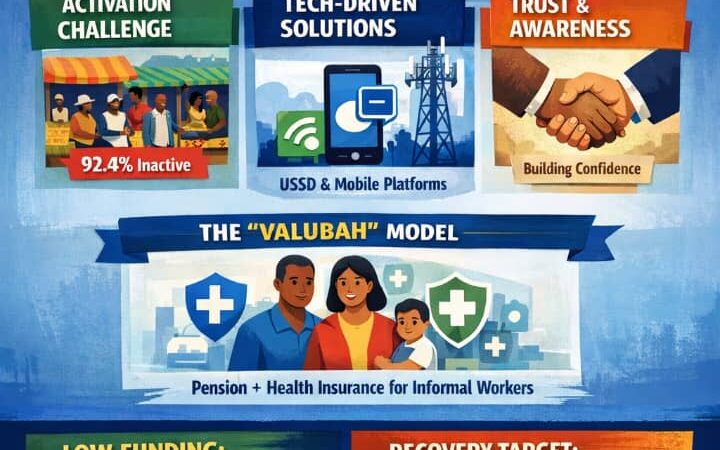

The National Pension Commission (PenCom) has said 215,914 out of Nigeria’s 92.1 million informal-sector workforce have personal pension plan (PPP), leaving a gap of 91.88 million.

The Pension industry regulator stated in its third quarter noting that the figure underscores the vast untapped potential of the informal sector and the urgent need for a broader, more coordinated effort by the Pension industry to deepen micro-pension penetration.

PenCom submitted that strengthening public awareness, expanding agent networks, and tailoring products to the realities of informal workers would be essential to achieving national pension inclusion targets and ensuring the long- term sustainability of the PPP.

“A review of PPP registrations in Q3 2025 shows that the market remained highly concentrated, with AccessARM and Stanbic IBTC together accounting for 68 per cent of all registered RSAs as at 30 September 2025. AccessARM maintained its dominant position with 50 per cent of total registered participants, while Stanbic IBTC accounted for 18 per cent.

PenCom stated that during the quarter, AccessARM continued to drive strong new registrations, in contrast to the modest growth recorded by Stanbic IBTC. Meanwhile, Parthian Pensions and CardinalStone Pensions Limited recorded minimal activity, contributing just 0.01 per cent and 0.02 per cent, respectively, to total registrations in Q3.

As at the end of the quarter, total Personal Pension Plan (PPP) contributors stood at 215,914, representing approximately 0.23 per cent of Nigeria’s 92.1 million informal-sector workforce (Source: Nigeria Labour Force Survey, NBS), it stated.