Cash transfer scheme: catalyst for personal pension growth

Kindly leave a comment and share

Chuks Udo Okonta

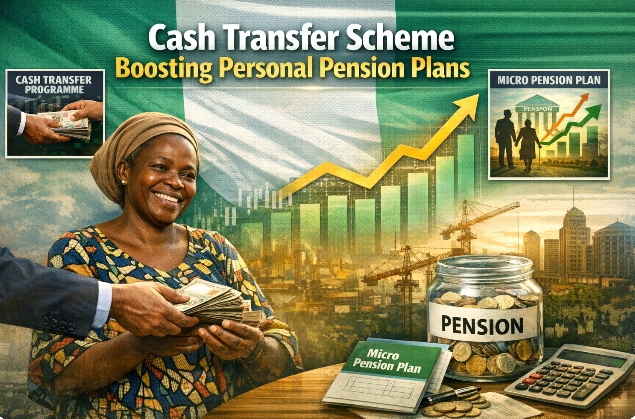

Stakeholders in the pension industry have urged the Federal Government to redesign its cash transfer support programmes to serve as a gateway for strengthening personal pension plans, particularly the Micro Pension Scheme targeted at informal sector workers.

They maintained that while cash transfers provide short-term relief to vulnerable Nigerians, linking the scheme to Retirement Savings Accounts (RSAs) would convert welfare spending into a sustainable tool for old-age financial security.

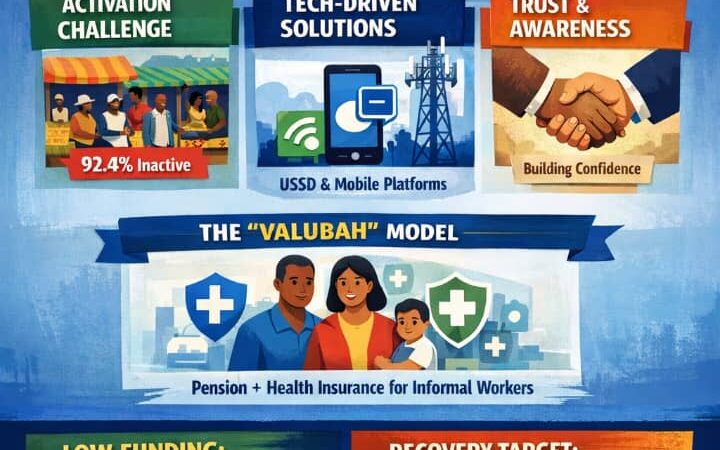

Nigeria operates various social investment programmes aimed at low-income households, traders and artisans. However, experts say the absence of a structured savings component means beneficiaries remain financially exposed once the interventions cease.

Recent data from the National Pension Commission (PenCom) show that micro-pension enrolment has crossed 120,000 contributors with total contributions exceeding ₦1.5 billion, a figure operators describe as promising but still far below the nation’s informal sector population estimated at over 60 million people.

PenCom statistics further indicate that awareness and irregular income remain the biggest barriers to participation, reinforcing calls for an incentive-driven model that can attract first-time savers.

Pension development advocate and Publisher of Inspenonline, Chuks Udo Okonta, said the country has a historic opportunity to use existing welfare infrastructure to build a retirement culture among the informal workforce.

“Government is already committing huge resources to cash support. If a fraction of these funds is channelled into micro-pension accounts, we would be empowering beneficiaries beyond immediate consumption and giving them dignity in retirement,” Okonta said.

He noted that many informal sector operators consider pensions as a privilege reserved for formal employees, adding that government-assisted contributions would change that perception.

“A matching contribution model can be introduced where, for every cash transfer received, a token is paid into the beneficiary’s RSA. Over time, this will nurture savings discipline without placing additional burden on the poor,” he added.

A senior executive of a Pension Fund Administrator (PFA) who spoke to Inspenonline said the proposal aligns with PenCom’s strategic objective to raise pension penetration to at least 30 per cent within the next few years.

“Micro pension is designed for market women, drivers, technicians and farmers. What has limited uptake is incentive. Cash transfer linkage can provide the motivation and scale we need,” he stated.

Industry analysts also observed that the model would expand pension assets, providing long-term funds for national development while reducing dependence on government in old age.

They recommended that the framework should include automatic enrolment of beneficiaries, flexible contribution structures, biometric identification and transparent reporting to build confidence.

Financial inclusion expert, Mary Oladipo, stressed that education must accompany the initiative.

“Beneficiaries need to understand that pension is future income, not another tax. Continuous enlightenment will determine the success of the policy,” she said.

Operators further called for collaboration between PenCom, the Ministry of Finance, the National Social Investment Programme Agency and PFAs to develop an integrated digital platform for seamless remittance and record keeping.

With Nigeria’s ageing population and shrinking family support system, experts believe transforming cash transfers into pension opportunities could become one of the most impactful social reforms.

For millions outside the formal sector, the strategy offers a simple promise: welfare today, security tomorrow.