Hardship: Retirees besiege PFAs for payment of pension en bloc

Kindly leave a comment and share

Chuks Udo Okonta

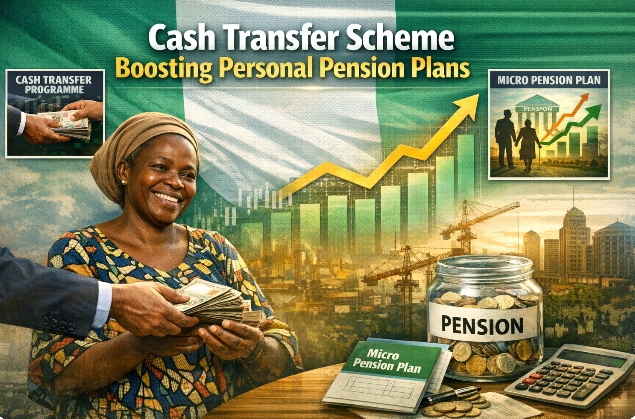

Following the National Pension Commission (PenCom) approval for retirees whose monthly/quarterly pensions are less than N23,333.33, representing one-third of the current minimum wage of N70,000.00, to choose between receiving the outstanding balance in their RSAs en bloc or continuing to receive their current monthly/quarterly pensions pending the commencement of the Minimum Pension Guarantee, both qualified and unqualified retirees are besieging their Pension Fund Administrators (PFAs) to access their funds and exit the scheme.

It was gathered that the tough economic situation in the country, constitute the main reason for the rush by retirees to exit the Contributory Pension Scheme (CPS).

Some of the qualified retirees told Inspenonline that they have filed their documents with their PFAs and are awaiting payments of their en bloc.

One of the unqualified retirees who said he needed money for medical care told this medium that he also went to his PFA when he heard about the approval, only to be told by his PFA that he is not qualified.

“With the high costs of living, my monthly pension of N47,666.62 can not sustain me, my monthly pension is below the new minimum wage of N70000, and there is a circular from PenCom which stipulate that those below the new minimum wage can collect their balance en bloc. I went only for my PFA to inform me that I’m not within the category.

“My monthly pension can not take care of my needs, I could have suggested that anyone whose monthly pension is below the national minimum wage who preferred to withdraw his balance en bloc should be allowed to do so, they should allowed pensioners like me to enjoy the fruits of my labours.

“The cost of medication is out of reach I’m a glaucoma patient, drugs are very expensive, old people need good food. My monthly pension can not cater for myself and family.

“Please advice the government to extend the policy to every pensioner whose monthly withdrawal is below the minimum wage to be allowed to withdraw their balance en bloc if they so desired.

“I need my to ventured into agriculture and complete my house in the village, to enable me move to my home town,” he posited.

A top executive of a PFA said his company has been attending to qualified retirees who are applying for their en bloc payment.

According to him many of the retirees have been settled by his company.

PenCom in a memo signed by the Head of the Surveillance Department of Pencom, simply identified as A.M Salem and dated November 27, 2024, said the approval followed the new section 4.1 (g) of the revised regulation on the administration of retirement and terminal benefits in line with the new minimum wage of N70,000.

Before this announcement, retirees are only allowed to withdraw one-third of their total RSAs.

The memo which was addressed to pension fund administrators and custodians said, “The commission has noted that President Bola Tinubu had on Monday, 29 July 2024, signed the National Minimum Wage Bill into law.

“Accordingly, the new National Minimum Wage Act increased the National Minimum Wage from N30,000.00 to N70,000.00.

“Section 4.1 (g) of the Revised Regulation on the Administration of the Retirement and Terminal Benefits (the Regulation) provides that where the Retirement Savings Account balance cannot provide a monthly/quarterly pension or annuity of at least one-third of the prevailing minimum wage, the retiree shall be allowed to take the entire balance in the RSA en bloc.

“Consequent to the above, Pension Fund Administrators are hereby directed as follows; To apply N70,000.00 being the current National Minimum Wage in processing of retirement benefits in line with the provisions of Section 4.1 (g) of the Regulation.

The memo noted that the requests for payments to retirees who choose to receive the outstanding balance in their RSAs en bloc should be forwarded to the commission with the documents listed below for consideration and approval.

The documents include “A consent form reflecting that the PFA properly enlightened the retiree on the Minimum Pension Guarantee and that he/she chose to receive the outstanding balance in the RSA en bloc.

“A hard copy application letter (not an electronic signature) signed by the retiree to withdraw the outstanding balance in the RSA.

“The payment schedule in the template is attached as Appendix 1. You are therefore required to take all necessary measures to ensure full compliance with this circular. This circular takes immediate effect.”