PFAs struggle to capture informal sector workers, register zero, three pension contributors

Kindly leave a comment and share

Chuks Udo Okonta

Onboarding informal sector workers in the Micro Pension Plan (MPP) has remained a great challenge for most Pension Fund Administrators (PFAs), as some of them recorded zero, three and eight contributors in the fourth quarter of 2024.

The National Pension Commission (PenCom) disclosed this in its fourth quarter 2024 report published on its website.

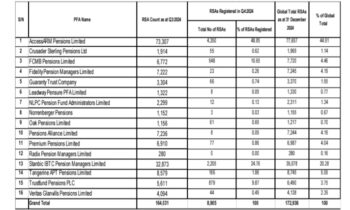

According to PenCom, a total number of 8,905 Micro Pension Contributors (MPC) were registered during the period under review by 16 Pension Fund Administrators bringing the total number registered MPCs from inception to 172,936 as at 31 December, 2024.

According to PenCom Radix Pension Managers Limited recorded zero contributors, while Norreberger recorded three.

The pension Industry regulator submitted that in the fourth quarter of 2024, AccessARM Pensions Limited emerged as the clear market leader in MPP registrations, stating that the PFA recorded 4,350 new registrations during the quarter, representing approximately 44.85 per cent of the total 8,905 contributors registered industry-wide.

It noted that this performance builds on a sustained track record, as AccessARM also holds the highest cumulative registrations since the inception of the MPP scheme.

It said by the end of December 2024, it had registered a total of 77,657 Micro Pension Contributors, representing

44.91 per cent of all contributors under the scheme. “This level of dominance reflects strategic advantages such as extensive grassroots mobilisation, consistent public awareness, and possibly more effective distribution or onboarding channels,” it added.

PenCom maintained that Stanbic IBTC Pension Managers Limited followed as a notable second, noting that in Q4 2024, the PFA registered 2,205 new contributors, accounting for 24.76 per cent of the

quarter’s total.

It submitted that cumulatively, it had onboarded 35,078 contributors by year-end, which equates to 20.28 per cent of total Micro Pension registrations.

PenCom said while its quarterly performance remains strong, the gap between Stanbic IBTC and AccessARM in

both quarterly and cumulative figures highlights the scale of AccessARM’s lead

and possibly signals a need for renewed growth efforts from other PFAs.

Combined, AccessARM and Stanbic IBTC registered 6,555 contributors in Q4

2024, accounting for 69.61 per cent of all new MPP registrations during the period, PenCom submitted.

It stated that together, they hold a cumulative market share of 65.19 per cent as of December 2024, stressing that this concentration points to a market dominated by just two PFAs, underscoring

the need for more inclusive participation and competitive momentum across the rest of the industry.

Their performance, it said not only sets the pace for MPP growth but also demonstrates the scale of opportunity within the informal sector for PFAs

willing to invest in outreach and innovation.

To reposition the MPP operations, PenCom said it has changed the name to Personal Pension Plan (PPP), stsing that the repackaged operations will be launched very soon.

According to PenCom the PPP would accommodate different kinds of people working and rendering services in the informal sector of the economy.