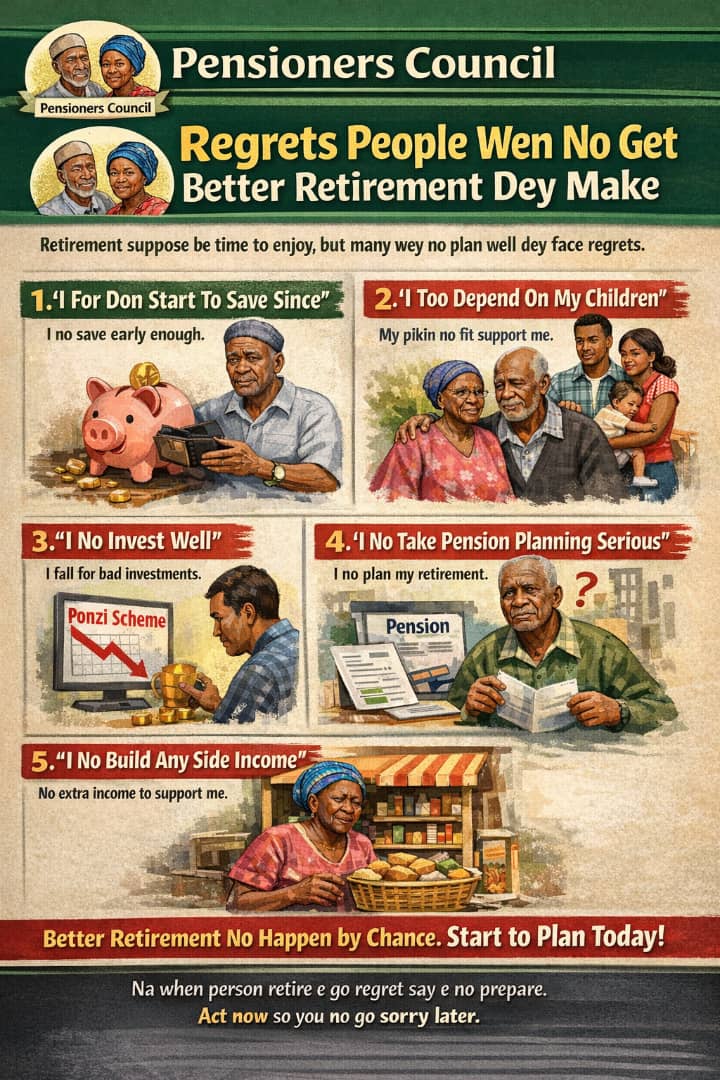

5 Regrets People Wen No Get Better Retirement Dey Make

Make you leave a comment and share

Blessing Chuks Okonta

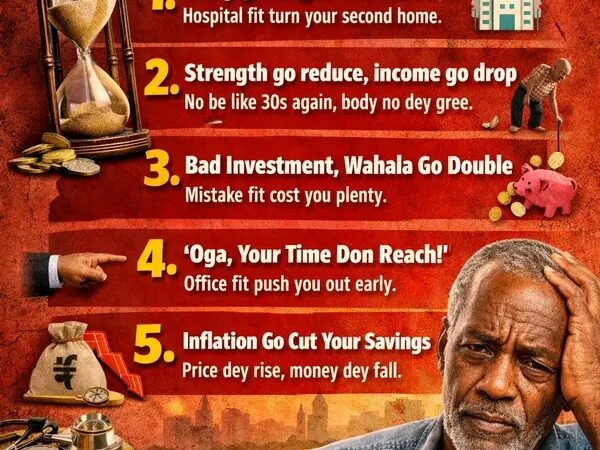

Retirement suppose be time to rest, enjoy family and reap the fruit of many years of labour. But for many Nigerians, especially those wey no plan well, retirement turn to season of regret and struggle.

Here are five common regrets people wey no get better retirement dey usually express:

1. “I For Don Start To Save Since”

This na the number one regret. Many retirees admit say dem underestimate how fast time go fly. Some think say pension go be enough. Others believe say dem still get time. Before dem know am, retirement don knock and savings no dey sufficient.

Lesson: The earlier you start, the easier am go be. Compound interest no dey pity late starters.

2. “I Too Depend On My Children”

Many retirees assume say their children go automatically carry the financial responsibility. But reality different. Children get their own families, bills and economic pressure.

When expectations no match reality, disappointment set in. Financial independence in retirement na dignity.

3. “I No Invest Well”

Some people only saved small small but never invested wisely. Money wey just sit down for ordinary account no go fight inflation.

Others fall victim of bad investments, Ponzi schemes or “quick profit” promises close to retirement. One wrong move fit wipe lifetime savings.

4. “I No Take Pension Planning Serious”

Whether na contributory pension, micro pension or personal pension plan, many people ignore structured retirement planning until e too late.

Some skip voluntary contributions. Some no monitor their pension growth. Some self no understand how their Retirement Savings Account (RSA) dey work.

Information wey dem ignore during working years later turn to regret.

5. “I No Build Any Side Income”

After salary stop, income stop. That reality hit hard for those wey no build alternative income sources while still active.

Rental income, small business, investments, consultancy — any extra stream could have reduced pressure. Retirement no supposed mean total financial shutdown.

Final Thought

Better retirement no happen by accident. E require intentional planning, discipline and financial education. The biggest regret no be poverty — na knowing say you had time to prepare but you didn’t.

The best time to start planning was yesterday. The next best time na today.