₦300bn fire claims in 10 years as insurers cushion policyholders’ losses

Kindly leave a comment and share

Chuks Udo Okonta

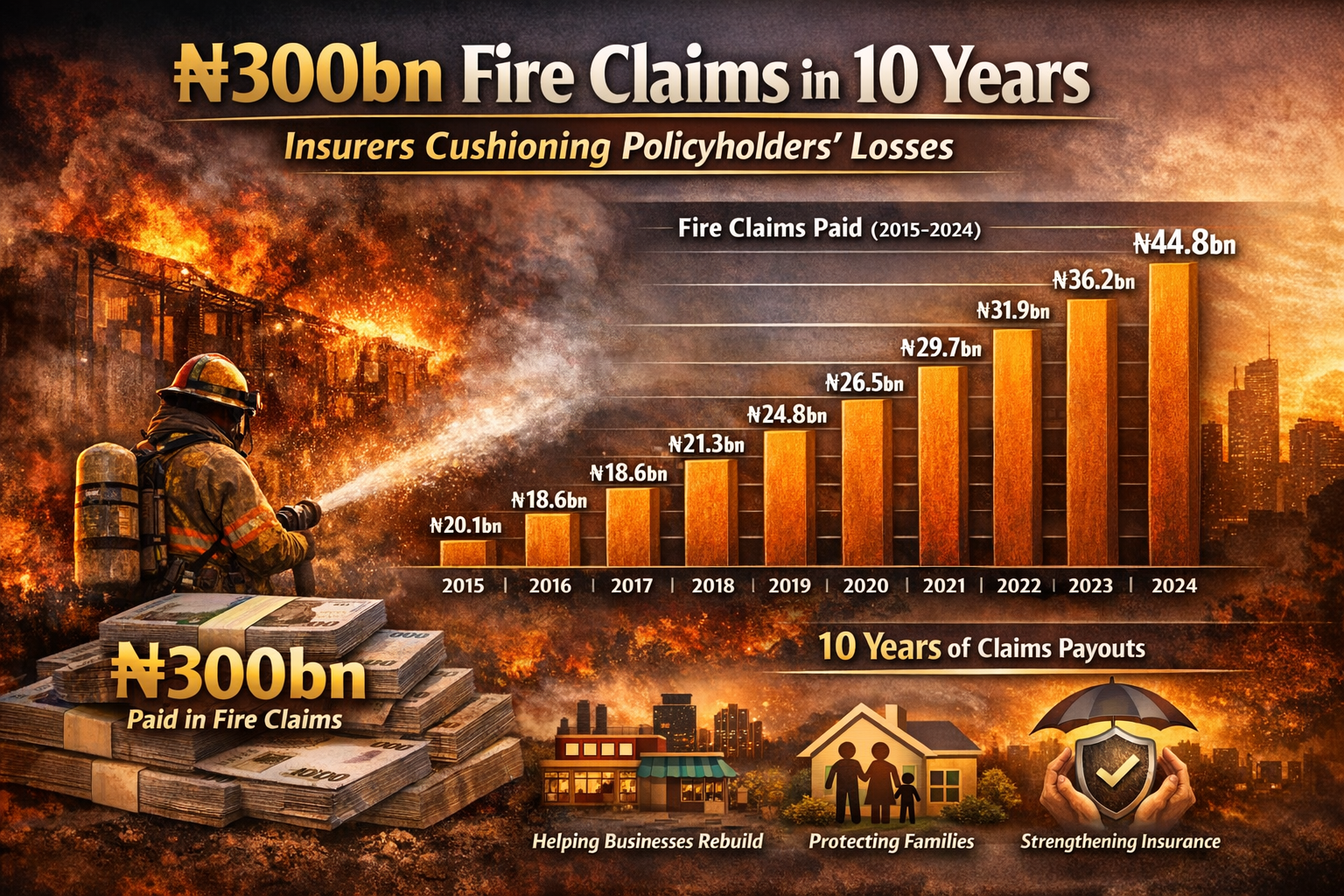

Insurance companies in Nigeria have paid an estimated ₦300 billion in fire-related claims over the past 10 years, providing critical financial relief to policyholders affected by devastating fire incidents across the country.

Findings from industry data and regulatory records show that between 2015 and 2024, insurers consistently settled claims arising from market infernos, industrial fires, office block outbreaks and residential property losses under fire and special perils insurance policies.

Fire outbreaks remain one of the most frequent and destructive risks facing businesses and households, often wiping out years of investment within minutes. However, claims payments by insurers have helped cushion the impact of such losses, enabling affected policyholders to rebuild assets, reopen businesses and restore livelihoods.

Available statistics indicate that annual fire claims payments rose steadily within the period, reflecting increased asset values, rising urban risks and improved claims responsiveness by insurers.

Estimated industry-wide fire claims payments over the decade include:

2015: ₦18.6bn

2016: ₦21.3bn

2017: ₦24.8bn

2018: ₦26.5bn

2019: ₦29.7bn

2020: ₦27.4bn

2021: ₦31.9bn

2022: ₦36.2bn

2023: ₦41.5bn

2024: ₦44.8bn

Cumulatively, fire and special perils claims payments during the period stood at approximately ₦303 billion.

Industry analysts attribute the growth to recurring electrical faults, gas explosions, overcrowded markets and industrial clusters, as well as improved enforcement of compulsory insurance in some sectors.

Claims settlements have proven particularly vital for traders, manufacturers and small business owners operating in high-risk commercial hubs such as Lagos, Aba, Onitsha, Ibadan and Kano. Insured policyholders affected by fire incidents in these areas were able to resume operations faster due to insurance compensation.

According to market operators, timely claims payments help prevent permanent business closure, job losses and long-term economic disruption. “Insurance remains the most reliable post-fire recovery mechanism for businesses,” a senior industry executive said.

Experts also note that sustained claims payments reduce reliance on government intervention and public donations after disasters. Instead of emergency relief, insured victims receive structured compensation based on policy coverage, promoting predictable recovery.

The National Insurance Commission (NAICOM) has repeatedly stressed that insurance plays a key role in shifting disaster recovery from public funds to risk-sharing mechanisms.

In recent years, insurers have introduced digital claims notification platforms, faster loss assessment processes and dedicated fire claims response teams to accelerate settlement timelines.

However, challenges such as underinsurance, non-disclosure and poor documentation still affect some claims. Insurers continue to urge property owners to insure assets at correct values and comply with policy terms to avoid disputes.

Stakeholders say the payment of over ₦300 billion in fire claims within a decade underscores the insurance industry’s capacity to absorb shocks and protect policyholders.

As fire risks persist, consistent claims settlement remains central to rebuilding confidence in insurance and strengthening Nigeria’s economic resilience.