BusinessToday 2026 conference holds April 2 spotlights youth in insurance, pension

Kindly leave a comment and share

All is set for the 2026 BusinessToday Annual Conference and Exhibition, themed “Youth Advantage: Redefining Insurance and Pensions for a New Era.”

The event is scheduled to hold on April 2, 2026, at the Ballroom of Oriental Hotel, Lekki, Lagos.

A statement by the Convener, Mrs. Nkechi Naeche-Esezobor, said the event will also feature a youth dialogue session, stressing that while the insurance practitioners would discuss “Insurance Reforms Made Simple, their counterparts from the pension sector would focus on “Start Young, Retire Strong: The PPP Advantage”

She said the Commissioner for Insurance/Chief Executive Officer National Insurance Commission (NAICOM), Mr. Olusegun Ayo Omosehin, and the Director-General, National Pension Commission (PenCom), Mrs. Omolola Oloworaran, are the Special Guests of Honour and have endorsed the conference.

The two regulatory agencies are expected to lead industry professionals in discussions focused on how young people can drive innovation, inclusion, and sustainability within Nigeria’s insurance and pension sectors.

Experts drawn from the insurance, pension, capital market, and information technology sectors will speak on the conference theme.

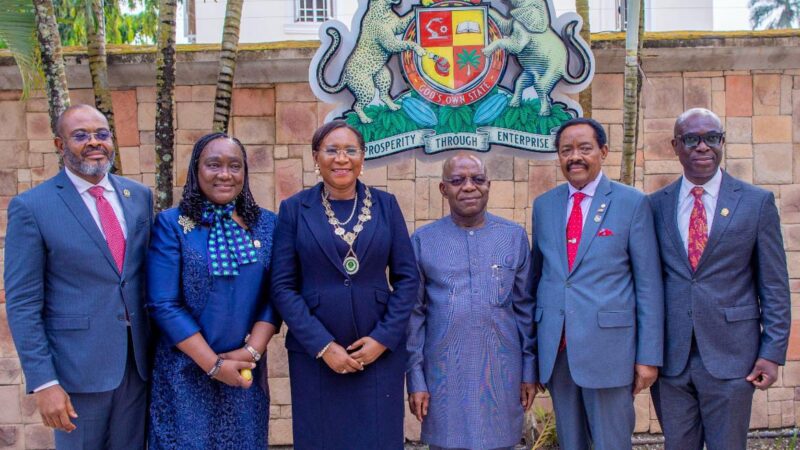

She disclosed that confirmed industry leaders expected at the event include the Chairman of the Nigerian Insurers Association (NIA), Mr. Kunle Ahmed; President of the Pension Fund Operators Association of Nigeria (PenOp), Mr. Christopher Bajowa; President of the Chartered Insurance Institute of Nigeria (CIIN), Mrs. Yetunde Ilori; and President of the Nigerian Council of Registered Insurance Brokers (NCRIB).

Also expected at the conference are Managing Directors and Chief Executive Officers of insurance and pension firms, the Director-General of the Nigerian Insurers Association, Mrs. Bola Odukale, as well as key stakeholders from across the financial services ecosystem.

On the theme of the event she said placing young people at the centre of sector reforms will help the insurance and pension industries build a stronger, more inclusive financial protection system.

She explained that the theme seeks to modernise insurance and pension products to reflect the realities of today’s youth-driven economy. With the growth of digital work, entrepreneurship, and the gig economy, the conference will promote flexible, affordable, and technology-enabled solutions tailored to young Nigerian.

This approach, she noted, is expected to close existing protection gaps and make insurance and pension products more accessible and relevant.

The conference is expected to attract over 20 speakers and more than 500 participants, including representatives from banking, technology, entertainment, content creation, media professionals, students from the University of Lagos, Yaba College of Technology, Trinity University, the Association of Mobile Money and Bank Agents in Nigeria (Lagos Chapter), and the Association of Registered Insurance Agents of Nigeria (ARIAN), among others.