Can insurance work for informal sector workers?

Kindly leave a comment and share

Blessing Chuks Okonta

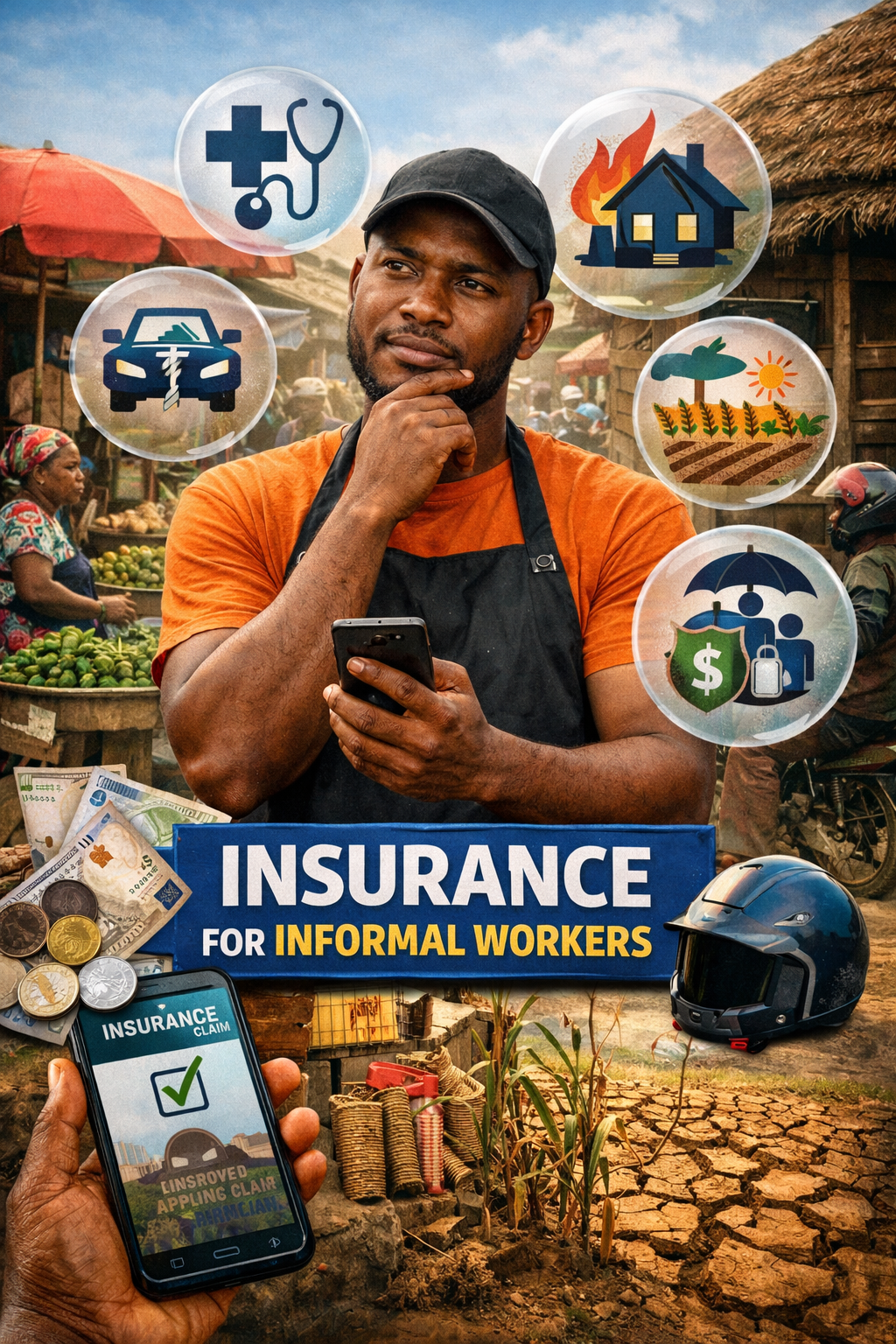

For millions of people working in Nigeria’s informal sector, insurance often feels like a product designed for “other people” — salaried workers, big companies, or those with steady monthly incomes. Market traders, artisans, ride-hailing drivers, farmers, and small business owners typically earn daily or irregular income, making traditional insurance plans seem out of reach.

But as risks increase and livelihoods remain vulnerable, the question is becoming harder to ignore: can insurance actually work for informal sector workers?

According to industry estimates, over 80 per cent of Nigeria’s workforce operates in the informal sector. These workers are exposed to everyday risks such as illness, accidents, fire outbreaks, theft, crop failure, and business interruption — often without any financial safety net.

When something goes wrong, the result is usually personal savings depletion, borrowing at high interest, or total business collapse. Insurance, in theory, is designed to prevent exactly this. The problem has been accessibility, trust, and affordability.

Conventional insurance products are usually built around:

Fixed monthly premiums

Formal employment records

Bank accounts and paperwork

Long policy documents and complex terms

For informal workers with fluctuating income and limited documentation, this model simply doesn’t fit. Many also distrust insurance due to past stories of unpaid claims or lack of understanding of how policies work.

To bridge this gap, insurers and regulators have increasingly turned to microinsurance — simplified insurance products specifically designed for low-income and informal workers.

Microinsurance typically offers:

Low and flexible premiums (daily, weekly, or pay-as-you-go)

Simple coverage and clear benefits

Faster claims processes

Distribution through mobile phones, cooperatives, trade associations, and digital platforms

Products now exist that cover health expenses, personal accidents, life insurance, crop loss, fire, and even phone or motorcycle damage — risks that informal workers face every day.

Mobile technology is playing a key role in making insurance workable for the informal sector. Premiums can be paid through mobile wallets, USSD codes, or agent networks, removing the need for bank visits or paperwork.

Claims can also be initiated digitally, sometimes with minimal documentation, speeding up payouts and improving trust. For many workers, their phone has become the entry point into insurance.

Despite these innovations, trust remains a major challenge. Many informal workers still see insurance as “money lost” if nothing happens. Others fear insurers will avoid paying claims.

Industry experts argue that building trust requires:

Clear communication in simple language

Consistent and visible claims payments

Education through community groups and trade unions

Strong regulatory oversight to protect policyholders.

Evidence suggests that when products are well designed and claims are paid promptly, insurance does work for informal sector workers. Those with coverage are more likely to recover quickly from shocks, keep their businesses running, and avoid falling into poverty after unexpected losses.

However, success depends on insurers meeting informal workers where they are — not forcing them into products designed for formal employment.

Insurance can work for informal sector workers, but only if it is affordable, flexible, easy to understand, and trustworthy. As microinsurance and digital distribution continue to grow, coverage for Nigeria’s informal workforce is no longer an impossible goal — but it remains a work in progress.

For millions living one incident away from financial hardship, insurance may not be a luxury after all, but a necessary tool for resilience.

Without trust, even the most affordable products will struggle to gain acceptance.

Experience shows that when insurance products are designed around the realities of informal work, they can be effective. Insured workers are better able to recover from setbacks, sustain their livelihoods, and avoid financial ruin after unexpected events.

The key lies in designing products that fit informal lifestyles rather than forcing informal workers into formal insurance structures.

Insurance can work for informal sector workers if it is affordable, flexible, easy to understand, and reliable. With the growth of microinsurance and digital platforms, extending insurance protection to Nigeria’s informal workforce is increasingly achievable.

For millions of Nigerians living one incident away from financial distress, insurance is not a luxury — it is a critical tool for financial resilience and economic stability.