CRC Credit Bureau, NAICOM move to integrate insurance data for enhanced risk management

Kindly leave a comment and share

Chuks Udo Okonta

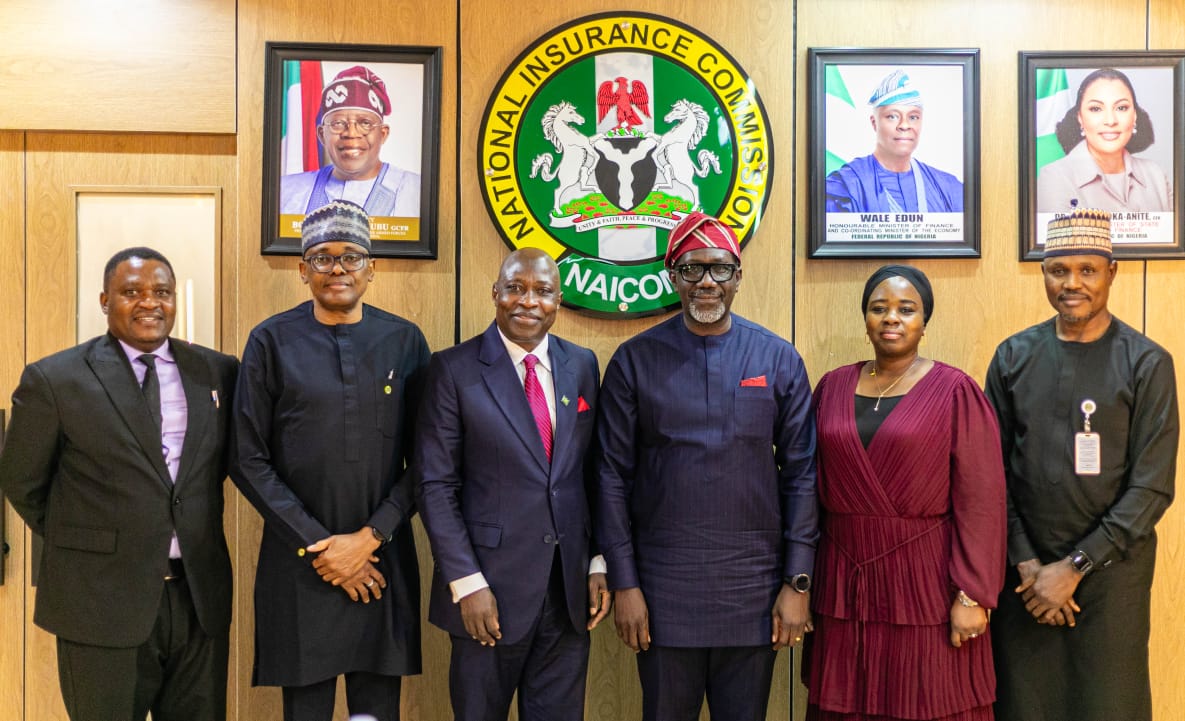

CRC Credit Bureau has initiated a strategic partnership with the National Insurance Commission (NAICOM) to integrate insurance data into the national credit reporting system, a move aimed at strengthening underwriting and curbing fraudulent activities in the industry.

The management of CRC Credit Bureau, led by its Managing Director/CEO, Dr. Tunde Popoola, formalised this intent during a courtesy visit to the Commissioner for Insurance, Olusegun Ayo Omosehin, at the Commission’s headquarters in Abuja.

Strengthening Underwriting and KYC

During the strategic session, Dr. Popoola emphasized that integrating insurance sector data is essential for driving digital adoption.

He noted that the collaboration would provide insurers with the tools needed for risk-based pricing and more accurate claims management.

”Our goal is to work with NAICOM to enhance the industry’s capacity to detect fraud and streamline customer verification through robust data analytics,” Popoola stated.

Responding to the proposal, the Commissioner for Insurance, Olusegun Ayo Omosehin, expressed the Commission’s commitment to leveraging CRC’s datasets to improve regulatory oversight.

He identified key areas where the partnership would add value, including:

Fraud Mitigation: Monitoring and detecting multiple claims and suspicious patterns.

Enhanced KYC: Leveraging existing credit data for seamless customer identification.

Industry Capacity: Training and development to equip operators with data-driven decision-making skills.

Both parties have agreed to a roadmap to ensure the successful implementation of this framework, which includes:

Technical Showcases: Product demonstrations and analytics displays for sector stakeholders.

Database Development: Drafting a proposal for a dedicated insurance-sector database and integration framework.

Operational Synergy: Closer collaboration on automated decisioning to support digital insurance products.

The integration is expected to revolutionize the Nigerian insurance landscape by fostering financial inclusion. With automated data flows, the industry will move toward:

More Accurate Pricing: Transitioning from flat rates to risk-based modeling.

Faster Claims: Speedier verification processes to improve customer trust.

Digital Expansion: Supporting the growth of InsurTech and digital-first insurance offerings.