FG welcomes insurance as indispensable mechanism for sharing climate change risks

Kindly leave a comment and share

Chuks Udo Okonta

The Federal Government has identified insurance as an indispensable mechanism to share and absorb shocks that it alone cannot shoulder.

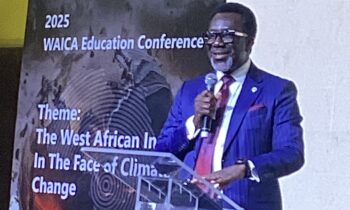

The Minister of State for Finance , Nigeria, Dr. Doris Uzoka-Anite said this while speaking at the ongoing 2025 West African Insurance Companies Association (WAICA) Education Conference in Lagos, adding that the federal government sees insurance as a shock absorber in disaster management such as climate change, noting that, insurance remains a major tool to limit the impact of. climate change on the region.

Represented by the Director, Home Finance, Federal Ministry of Finance, Dr. Ali Mohammed, she said, climate change should be treated with a collective solution, calling on West African countries through WAICA to develop regional risks mitigation mechanism and exchange data to address the impact of climate -related risks across the region.

“We must treat climate change not only as an environmental challenge but also as a financial imperative. Africa already loses billions annually to climate-related disasters. Traditional budgets can no longer cope.

“Hence, Nigeria is advancing frameworks that combine sovereign risk insurance, regional disaster-risk pools, and public–private climate-finance mechanisms to ensure rapid response and fiscal stability. These tools strengthen preparedness and prevent disruptions to essential development programmes, ” she pointed out.

She noted that the task before West African insurers is collective, but the opportunities are immense, she added that, through sound governance, strong regulation, and regional collaboration, ‘we can make insurance a cornerstone of West Africa’s sustainable development story.’

In 2024, floods affected about 7.5 million people in Nigeria and 16 other West African countries, it was learnt.

The floods were a result of climate change, which has increased the frequency of extreme rainfall events in the region, leading to significant loss of life and livelihoods.

Nigeria alone accounted for 1.3 million displaced persons last year.

The commissioner for Insurance/CEO, National Insurance Commission (NAICOM), Olusegun Omosehin noted that, in 2025,, over 33,000 Nigerians were displaced, 3,800 homes destroyed, and 5,300 hectares of farmland submerged—threatening food security and economic stability.

According to him, “these are not just statistics—they are stories of disruption, loss, and delayed development. Yet, within this crisis lies an opportunity: to redefine the role of insurance as a force for resilience and sustainable development.”

To address this scourge, he said, NAICOM s committed to enabling policies that foster collaboration between operators, regulators, and development partners.

Strengthening climate resilience across West Africa, he said, demands a unified approach—one that blends sound regulation, market innovation, and strategic partnerships.

Meanwhile, the chairman of the Local Organising Committee (LOC), 2025 WAICA Education Conference, Mrs. Ebelechukwu Nwachukwu said, insurance operators in Nigeria and other West African countries have evolved several climate change-related insurance policies to tackle this scourge.

Nwachukwu, who is also the managing director/CEO, Rex Insurance Limited, expected the forum to evolve other innovative ways of addressing this scourge, especially, flooding, in West Africa through innovative policies and structures that will make underwriters play a big role in addressing impacts of this natural disasters on the region.

Similarly, the president of WAICA, Solomon Anthony Sesay, stated that, his association always encourages the development of the insurance market in each member country on sound and technical basis, noting that, the choice of the theme of the conference ‘The West African Insurer In The Face of Climate Change,’ is timely in the midst of threat that comes with Climate Change on the West African region.

He said, his association has assembled the best brains on African soil to do justice to the theme, believing that, the outcome will open a new chapter in the fight against climate change issues through the mechanism of insurance.

On his part, Corps Marshal and chief executive of the Federal Road Safety Corps (FRSC), Shehu Mohammed, disclosed that, climate change, especially, flooding, had and continues to cause road accidents across the country.

Mohammed, who was represented by Assistant Corp Marshal, Mrs. Oladayo , promised that, the corps will work with WAICA and the Nigerian Insurers Association (NIA) and other stakeholders in insurance industry to evolve solutions to continue to safeguard lives and properties across the country.