Is insurance a scam? 5-year claims data tells different story

Kindly leave a comment and share

Chuks Udo Okonta

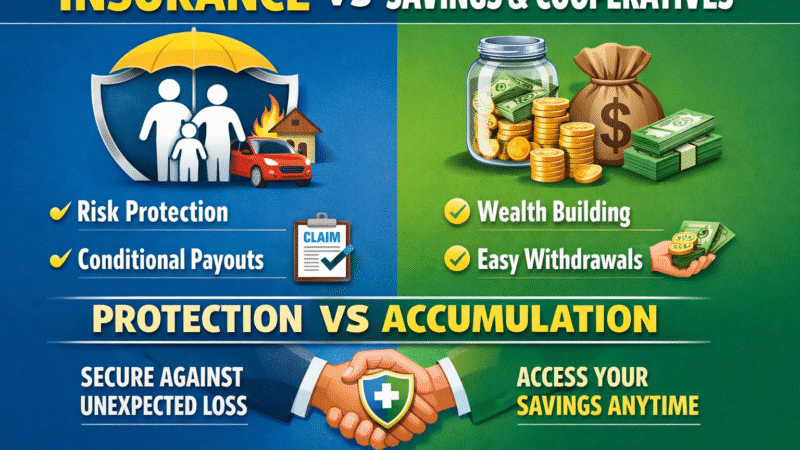

The perception of insurance as a scam remains widespread among Nigerians, a sentiment that has continued to suppress insurance penetration to below one per cent of Gross Domestic Product (GDP). However, industry data on claims payments over the last five years suggests a different narrative—one that points to an industry quietly paying billions of naira to policyholders across sectors of the economy.

Insurance professionals argue that while operational gaps and unethical practices exist, insurance itself is not a scam but a regulated risk-sharing mechanism that has delivered tangible value through claims settlements.

Data compiled from industry reports and regulatory disclosures indicate that Nigerian insurers paid an estimated ₦1.9 trillion in claims between 2019 and 2024, underscoring the sector’s role as a financial shock absorber.

A breakdown shows that:

2019: Insurers paid about ₦410 billion in claims, driven largely by oil and gas, fire, and motor insurance losses.

2020: Despite the economic slowdown caused by COVID-19, claims payments stood at approximately ₦360 billion, with health, group life and business interruption claims featuring prominently.

2021: Claims rose to about ₦430 billion, reflecting increased underwriting activities and recovery in key sectors of the economy.

2022: Industry claims payments climbed to an estimated ₦470 billion, boosted by higher losses in motor, aviation and oil and gas insurance.

2023/2024: Preliminary figures indicate claims payments of about ₦520 billion, the highest in the five-year period, as inflation, higher asset values and expanded coverage increased claims costs.

Industry analysts note that oil and gas, motor, fire, aviation and group life insurance consistently accounted for the largest share of claims paid during the period.

Why the scam perception persists

Despite these figures, distrust remains high. Experts attribute this to delayed claims settlement in some cases, complex policy wordings, poor customer communication and the activities of unlicensed agents selling fake or invalid policies.

“When people have a bad claims experience or fall victim to fake insurers, they generalise it to the entire industry,” an insurance practitioner said.

Low insurance literacy has also played a role, as many policyholders do not fully understand exclusions and conditions attached to their policies before purchasing them.

The National Insurance Commission (NAICOM) has intensified market conduct supervision, enforcement of compulsory insurance policies and deployment of digital verification platforms to curb fake insurance. The Commission has also sustained the “No Premium, No Cover” policy and recapitalisation drive to strengthen insurers’ balance sheets and claims-paying capacity.

According to NAICOM, these measures are aimed at restoring public confidence and ensuring that only financially sound operators remain in the market.

Financial analyst, Chuks Udo Okonta, said claims statistics clearly show that insurance works. “Insurance is not a scam. Over the last five years alone, insurers have paid close to ₦2 trillion in claims. The challenge is trust, transparency and communication, not the concept of insurance itself,” he said.

Analysts agree that rebuilding trust will require insurers to pay claims faster, simplify policy documents and engage policyholders more transparently. Consumers, on the other hand, are advised to buy insurance only from licensed companies and verify policies through NAICOM’s platforms.

While image challenges persist, the five-year claims data reinforces the argument that insurance remains a vital financial safety net—one that continues to support businesses, households and the broader Nigerian economy, often out of the public spotlight.