KBL Insurance champions public awareness on Third-Party Motor policy

Kindly leave a comment and share

Chuks Udo Okonta

KBL Insurance Limited is stepping up efforts by drawing the attention of members of the public to road safety and regulatory compliance with relevant insurance laws and regulations.

The Underwriters are launching an extensive awareness campaign on the Third-Party Motor Insurance. Predicated on the move to ensuring compliance with Section 68 of the Insurance Act 2003, the initiative is designed to educate motorists on their legal obligations, the benefits of coverage, and the consequences of non-compliance.

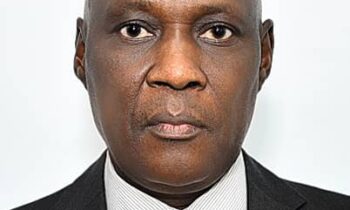

Responding to media inquiries in Lagos on Monday, February 3 2025, Managing Director/CEO of KBL Insurance Limited Lawal Mijinyawa, emphasized the Company’s commitment to customer convenience and regulatory compliance, where he called on the general public to comply with the regulation, detailing the importance of Motor Insurance.

He assured customers, saying:”At KBL Insurance Limited, we believe insurance is more than just policies. It is about protecting lives, securing assets, and ensuring peace of mind.

“Our goal is to simplify Third-Party Motor Insurance so that every vehicle owner in Nigeria remains compliant with the law while benefiting from seamless insurance coverage and top-tier customer support.”

The Third-Party Motor Insurance is mandatory for all vehicle owners, as it is now enforced by the Nigeria Police Force and the National Insurance Commission (NAICOM).

The policy provides financial protection by covering liabilities for damages or injuries caused to third parties in the event of accident.

Despite its legal requirement, many motorists are unaware of the serious risks of driving without valid insurance. A defaulter could pay a fine of N250,000, which may include impounding the vehicle along other strict sanctions.

The exercise has since begun in Lagos, Akwa Ibom, and Edo States, where the Police announced the full implementation. This is in compliance with the directive of the Inspector General of Police, IGP Kayode Egbetokun, PhD.

KBL Insurance Limited is committed to bridging this gap through increased awareness activities, radio jingles, market storms, seminars, and an improved service experience.

To make insurance more accessible, faster and stress-free, KBL Insurance Limited has upgraded its digital platforms and customer support services. Customers can now conveniently subscribe or renew their policies from the comfort of their homes through an easy-to-use online portal, www.kblinsurance.com/panel.

KBL Insurance has also strengthened its nationwide customer support team, to provide real-time assistance, ensuring that policyholders receive seamless service.

Additionally, the claims process has been optimized for speed, transparency, and minimal turn-around time, allowing customers to get payouts without delays.

With affordable premiums starting at just N15,000 per year, Third-Party Motor Insurance provides crucial protection while ensuring compliance with the law.

The policy covers damages to other vehicles, third-party property, and bodily injuries caused by the insured vehicle.

By maintaining valid coverage, motorists can avoid unnecessary legal troubles and financial burdens while enjoying peace of mind on the road.

Motorists can easily purchase or renew their Third-Party Motor Insurance policy by contacting KBL Insurance Customer Service at 08090512127 or 07040345052, visit the official website at www.kblinsurance.com, or access the dedicated online portal at www.kblinsurance.com/panel.

Customers can also walk into any KBL Insurance branch nationwide for assistance. Updates and additional information are available through KBL Insurance’s social media channels on Facebook, X (Twitter), LinkedIn, and Instagram.

With this renewed commitment to innovation, customer satisfaction, and regulatory compliance, KBL Insurance Limited continues to lead the way in delivering reliable insurance solutions that keep Nigerians protected on the road.KBL Insurance Limited – We truly care!