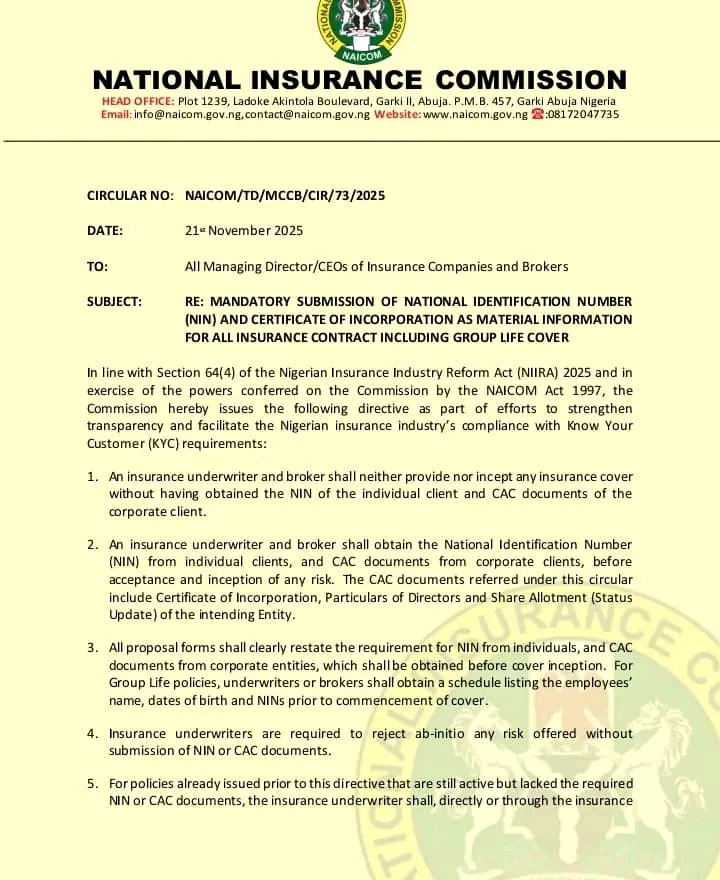

NAICOM gives April 30, 2026 deadline for NIN, CAC document link with insurance policies

Kindly leave a comment and share

Chuks Udo Okonta

The National Insurance Commission (NAICOM) has given April 30, 2026 deadline for National Identification Number (NIN) and Corporate Affairs Commission (CAC) documents linkage with insurance policies, even as it has

threatened to sanction any insurance company that provides or incept a cover to policyholders without the requirements.

NAICOM stated this in a circular issued today with the title; ‘Re: Mandatory Submission of National Identification Number and Certificates of Incorporation as Material Information for all Insurance Contract Including Group Life Cover’ signed by the Deputy Director Market Conduct & Compliants Bureau Olugbenga Jayesimi and send to all Managing Directors/Chief Executive Officers of insurance companies and brokers.

NAICOM stated that in line with Section 64(4) of the Nigerian Insurance Industry Reform Act (NIIRA) 2025 and in exercise of power conferred on it by NAICOM Act 1997, it issues the following directives as part of efforts to strengthen transparency and facilitate the Nigerian Insurance Industry’s compliance with Know-Your- Customers (KYC) requirements.

NAICOM said it will monitor the circular and take appropriate regulatory action to ensure strict compliance.

It said an insurance underwriter and broker shall neither provide nor incept any insurance cover without having obtained the NIN of the individual client and CAC documents of corporate clients.

NAICOM maintained that underwriters and brokers shall obtain NIN from individual client and CAC documents from corporate clients before accepting and inception of any risk.

It noted that the CAC documents referred under the circular include certificate of Incorporation, particulars of directors and share allotments (Status update) of the intending entity.

It said underwriters are required to reject ab-initio any risk offered without submission of NIN or CAC documents.

NAICOM submitted that for policies already issued prior to the directive that are still active but lack the required NIN or CAC documents, underwriters shall directly through insurance intermediaries engage the policyholders to obtain same and link the information to the respective customer’s records on or before April 30, 2026.

The regulator mandates insurers to collaborate with brokers and agents to intensify customer awareness campaigns.