NAICOM tightens oversight, insurers adjust to new capital reality as NIIRA 2025 clocks 6 months

Kindly leave a comment and share

Chuks Udo Okonta

Six months after the Nigerian Insurance Industry Reform Act (NIIRA) 2025 came into effect, the National Insurance Commission (NAICOM) has intensified regulatory oversight, pushing operators to align with new capital, governance and compliance standards aimed at repositioning the industry.

NIIRA 2025 was signed into law by President Bola Ahmed Tinubu on August 5, 2025. This legislation serves as a comprehensive reform to modernise the insurance sector, repealing older laws to introduce higher capital requirements, improved corporate governance, and increased policyholder protection.

The reform, widely regarded as the most comprehensive overhaul of insurance regulation in decades, is already reshaping boardroom strategies, capital structures and operational models across the market.

At the core of NIIRA implementation is the new Minimum Capital Requirement (MCR) framework.

Since the law came into force, NAICOM has rolled out detailed guidelines on recapitalisation modalities, statutory deposits and transitional compliance measures. Several underwriting firms have announced fresh capital injections, while others are exploring mergers, acquisitions and strategic partnerships to meet the new thresholds.

Industry watchers say the recapitalisation drive is gradually restoring investor confidence and compelling weaker firms to either strengthen their balance sheets or consider consolidation.

A senior industry executive who spoke with Inspenonline noted that the reform “is forcing operators to think long term. The days of thin capitalisation and weak underwriting capacity are gradually coming to an end.”

Within the past six months, the Commission has increased off-site monitoring and on-site inspections, insisting on timely submission of audited accounts and strict compliance with solvency margins.

Operators confirm that regulatory engagement has become more rigorous, with greater scrutiny on financial disclosures, reserving standards and corporate governance practices.

Analysts say this renewed firmness signals a shift from regulatory forbearance to a discipline-driven regime designed to protect policyholders and enhance market stability.

Another major milestone recorded in the first six months is the acceleration of Risk-Based Supervision (RBS).

NAICOM has intensified capacity-building engagements, requiring insurers to strengthen enterprise risk management systems, actuarial processes and internal controls.

Under the new regime, capital adequacy is now more closely aligned with risk exposure, a move experts believe will promote underwriting discipline and reduce systemic vulnerabilities.

Beyond capital reforms, NIIRA places strong emphasis on policyholder protection.

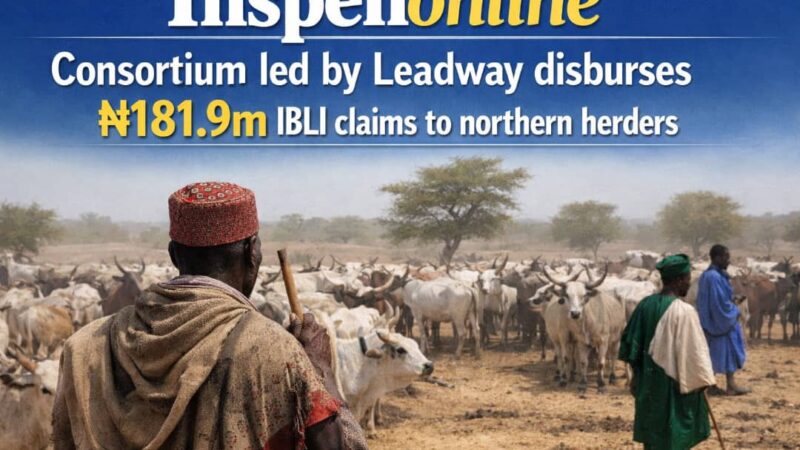

The Commission has reinforced claims settlement guidelines, complaint resolution channels and market conduct supervision. There are also renewed signals that enforcement of compulsory insurance classes—such as motor third-party, group life and builders’ liability—will be stepped up.

Stakeholders say improved enforcement in these areas could significantly boost insurance penetration and rebuild public trust.

While most operators acknowledge that NIIRA is necessary for long-term industry growth, some have raised concerns about tight compliance timelines amid prevailing economic headwinds.

An insurance chief executive told Inspenonline that “the reform is positive and inevitable, but regulators must remain mindful of macroeconomic pressures affecting capital raising efforts.”

Despite these concerns, there is broad consensus that the reform is setting a new tone for transparency and accountability.

Though still in its early phase, NIIRA’s implementation is already influencing strategic decisions across the industry.

Experts believe stronger capital buffers will enable Nigerian insurers to retain more big-ticket risks in oil and gas, aviation, marine and infrastructure sectors—areas historically ceded to foreign markets.

If sustained, the reform could significantly improve the industry’s contribution to national GDP and financial inclusion objectives.

As NIIRA implementation moves beyond its first six months, attention will focus on meeting recapitalisation deadlines, strengthening digital supervision and expanding insurance access to underserved segments.

For NAICOM, maintaining reform momentum while ensuring market stability remains the critical balancing act.

Six months on, one message is clear: NIIRA has reset regulatory expectations, and operators must adapt swiftly to remain relevant in Nigeria’s evolving insurance landscape.