NAICOM woos NCRIB on development of broker-led microinsurance, takaful solutions

Kindly leave a comment and share

Chuks Udo Okonta

The National Insurance Commission (NAICOM) is seeking partnership with the Nigerian Council of Registered Insurance Brokers (NCRIB) to develop broker-led microinsurance and takaful solutions.

The Commissioner for Insurance Olusegun Omosehin, said this at the investiture of Mrs. Ekeoma Ezeibe as as the 23rd President of NCRIB in Lagos.

Omosehin also inviteed the NCRIB, under Mrs. Ezeibe’s leadership, to actively partner with the Commission in implementing the provisions of Nigerian Insurance Industry Reform Act (NIIRA) 2025, adding that NAICOM remains open to dialogue and committed to harmonizing the roles of all industry players.

From left: former Commissioners for Insurance Sunday Thoman; Muhammed Kari and former Director Supervision National Insurance Commission Barineka Thomson at the event.

From left: former Commissioners for Insurance Sunday Thoman; Muhammed Kari and former Director Supervision National Insurance Commission Barineka Thomson at the event.

The CFI noted that he was honoured to celebrate Mrs. Ekeoma Ezeibe on her investiture as the 23rd President of the NCRIB, stating the industry celebrates not only a new chapter in the leadership of the NCRIB, but also the remarkable journey of a woman whose life and career embodies excellence, resilience, and visionary leadership.

To every broker who continues to uphold the core values of professionalism, integrity, and client-centric service, Omosehin thanked them for their unwavering commitment which he said is the foundation of the industry’s success.

He submitted that the new President Mrs. Ezeibe’s emergence as the third female President in the 63-year history of the Council is a powerful symbol of progress and inclusion, noting that her journey is one of quiet strength and strategic impact both at NCRIB and the insurance industry.

“Of note is her strategic leadership as Chairperson of the Nigerian Insurance Industry Committee on AfCFTA (NII-AfCFTA). Under her guidance, the Committee has championed industry enlightenment, capacity building, and policy advocacy to ensure Nigerian insurance industry is well-positioned to harness the opportunities of the African Continental Free Trade Area,” he posited.

The insurance industry regulator noted that as they celebrate the investiture, they should reflect on the leadership imperatives that will shape their future.

He called for empowering professionals and stakeholders through enhanced knowledge and awareness; upholding integrity, transparency, and professionalism in all our engagements and building trust through consistent performance, clear communication, and fair practices.

He maintained that in insurance, perception and performance are inseparable, stating that trust grows when operators actions meet stakeholder expectations.

“Under Mrs. Ezeibe’s leadership, I am confident the NCRIB will champion these imperatives and drive our industry toward greater excellence.

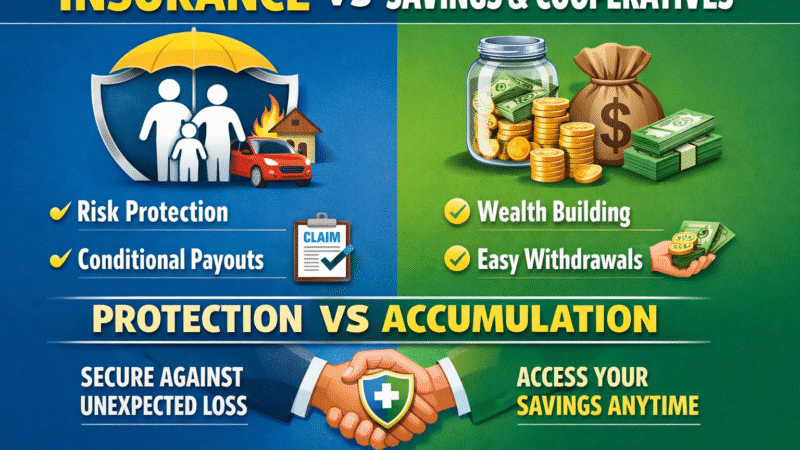

“In today’s dynamic environment, brokers must evolve to meet emerging risks. This includes: Providing client-first risk advisory, not product-driven solutions.

“Ensuring transparent placement with clear wordings and quality coverage.

“Leading claims processes with data-driven, empathetic approaches.

“Expanding inclusion through affordable microinsurance for underserved sectors.

“Leveraging digital tools to reduce costs while maintaining ethical standards,” he added.

Omosehin urged the Council to professionalise these capabilities through training, peer review, and accountability.

He noted that the reputation of insurance market is inseparable from the reputation of its brokers.

The Commissioner for Insurance noted that at the National Insurance Commission, their priorities are clear:

“We aim to foster innovation, protect policyholders, and build public confidence.

“For brokers, our regulatory focus includes:Risk-Based Supervision: Aligning governance and financial requirements with business scale.

“Market Conduct Oversight: Ensuring transparency, suitability, and fairness—especially during claims.

“Data and Reporting Enhancement: Making placement quality and client outcomes measurable.

“Technology Enablement: Facilitating digital KYC, API-enabled placement, and efficient claims portals,” he posited.

According to him NAICOM’s stance is simple: deliver only what you can support, and support everything you deliver. Clear promises and prompt service build trust—and trust drives penetration.

In his charge to the new President Mrs. Ezeibe, he said: “As you assume this esteemed role, I charge you to lead with:

Professionalism that sets new benchmarks.Inclusion that brings every Nigerian into the safety net.Innovation that transforms how we serve.

“Trust that anchors our market’s reputation. Let your tenure be defined by bold decisions, ethical leadership, and transformative impact.

“The future of our industry depends on visionary leaders like you.”

He called for the building of an insurance market that serves Nigerians better and strengthens the economy.

Omosehin also has glowing words for the immediate past President of the NCRIB Babatunde Oguntade, he extended heartfelt appreciation to him for his courageous and visionary leadership.

He noted his tenure exemplified the blend of integrity, patience, and foresight required to guide our industry.

His dedication to advancing our profession and upholding its highest standards has been truly commendable, Omosehin submitted.