Sad demise of Kano athletes: Where insurance missed it

Kindly leave a comment and share

Its quite devastating that 19 young athletes from Kano State, who had just represented their state with pride at the National Sports Festival in Ogun, tragically lost their lives in a road crash. A case of promising talents gone too soon.

As the state mourns its heroes, joined by other sympathisers all over the country and beyond, one question demands urgent attention: Did these athletes have Group Personal Accident (GPA) or life insurance coverage in place?

They gave their best. They brought home medals. But who protected protecting them in return against this type of calamitous incident?

Now, the insurance industry must ask itself:

How many more lives must be lost before proactive, athlete-centered insurance becomes non-negotiable?

Generally, It’s time to move from reactive payouts to preventive policies. It’s time the insurance industry did more while government and big entities employing good number of Nigerians become more receptive to risk management ideas of which insurance is cardinal.

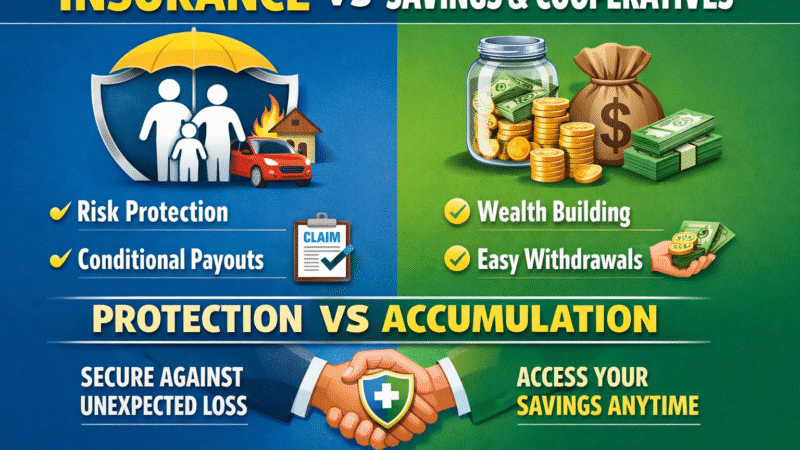

Whilst not dancing on the grave of these young demising patriots to sell insurance, it simply makes sense to consider insurance as a necessary option in the protection of lives and properties against fortuitous losses like the one in question.

If corporate entities are lax in providing these covers, it behoves individuals who consider their lives worthy to compel their employers to undertake it on their behalf.

Imagine the athletes were insured, it would have been a good platform for commiseration and to show case the place of insurance as protective device in times of uncertainty

Tayo Akpan

INSURTAINMENT — bridging the gap between two worlds.