Unitrust Insurance rewards companies, individuals for over 20 years patronage

Kindly leave a comment comment and share

Chuks Udo Okonta

Unitrust Insurance Company Limited has rewarded 43 companies and individuals for insuring with it for over 20 years.

The loyal companies and individuals were celebrated at the company’s 2025 Customers’ Night held yesterday in Lagos.

The Managing Director/CEO Unitrust Insurance Company Limited Arowojolu Adedayo, while appreciating the loyal customers, said words cannot fully express the firm’s deep appreciation to them for taking time out to honour invitation to the event.

He noted that the importance of customers to any business cannot be overemphasized, stating that no business can survive nor thrive without the support of customers.

“Since the commencement of Unitrust Insurance Company Limited operation in February 1986, and our brief period of transition to Saham Unitrust Insurance Company Limited, it is heartwarming to note that most of our customers had stood by us and exhibited unwavering loyalty to the Unitrust brand.

“Tonight’s event is to show our appreciation for your unflinching support over the years despite stiff competition from other insurance industry players.

“We cannot take your loyalty to the Unitrust brand for granted. We are aware, as it happens in most relationships, you may have had some period of disappointments,” he said.

He submitted that their decision to keep faith in the Company, is much appreciated, adding that the business environment is constantly changing, so are customers’ expectations.

According to him to ensure that the company meets its customers’ expectations, it is constantly reviewing its processes and value proposition to guarantee the delivery of excellent service to its cherished customers.

“Permit me to use this opportunity to intimate you of some of the key initiatives we have invested in to improve our customer experience. 48 hours Claims Settlement After Receipt of Discharged Vouchers (DV) – In the last two years, this has been our service promise to our customers.

“Realizing that prompt claims settlement is the hallmark of any serious insurance company. We have put in place internal processes that has supported us in delivering this service promise to all our customers. I believe most of you here tonight can attest to this.

“As a testament of our commitment, we paid a total claim of over N9 billion in 2024. Not only that, but we are also reaching out to customers with outstanding claims to document their claims to enable us to settle them without further delays.

“Deployment of Webplug Application – to minimize the process of claims documentation, we have developed this application to fast-track claims process from notification to offer of settlement with a view to minimizing the entire claims turnaround time and further improve customer experience.

“The link to access Webplug is now being included on our Policy Documents, Claims Acknowledgement email/letters and Renewal Notice for your use. This application can also be used to renew existing businesses and onboard new businesses.

“Deployment of UNIS (WhatsApp Chatbot) – UNIS is AI application for onboarding new motor policies. We will be demonstrating the use and capabilities of the application during tonight’s programme.

“We encourage you to use these applications and enjoy the experience of seamless service delivery,” he posited.

He maintained that aside the improvement in claims’ services, the firm is constantly improving its interactions and engagements with its customers in other to guarantee value for money.

Such engagements, he said have led to risk advisory services, implementation of risks improvement measures such as conducting free training of drivers to minimize operational losses and disruptions of business activities.

“We promise to continue to do this to guarantee a win-win relationship. As you are aware, upon the assent of requisite authorities of the New Insurance Bill, insurance companies in Nigeria will be expected to increase their minimum capital requirements. For Non-Life Companies such as Unitrust Insurance Company Limited, our minimum capital requirement has been increased to N15 billion from the current N3 billion.

“I am happy to inform you that our current position is more than N30 billion and you can be rest assured that your risks are secured with Unitrust,” he submitted.

He also appreciated the support of the firm’s key partners namely, Insurance Brokers and other intermediaries and Reinsurers who have been very supportive and reliable partners over the years.

Adedayo assured them that the company would not rest on its oars, but rather continue to seek better ways of making their experience with Unitrust Insurance Company Limited more enjoyable.

“There is a popular saying that ‘You should not put all your eggs in one basket’. I beg to differ, once it comes to where to place all your insurances, we guarantee you that your risks are well secured with us. You don’t need any other insurance company to place your risk,” he submitted.

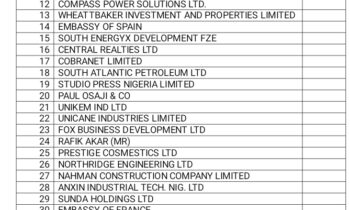

Some of the companies and individuals rewarded are: T.Y. Holdings; Hi-Tech Construction Company Limited; Black Diamond Suites and Apartments; Austrian Embassy – Commercial Section; Embassy of France; Bank of Beirut; Dr. Henrietta Onwuegbuzie amongst others.