What’s government doing to protect policyholders?

Kindly leave a comment and share

Blessing Chuks Okonta

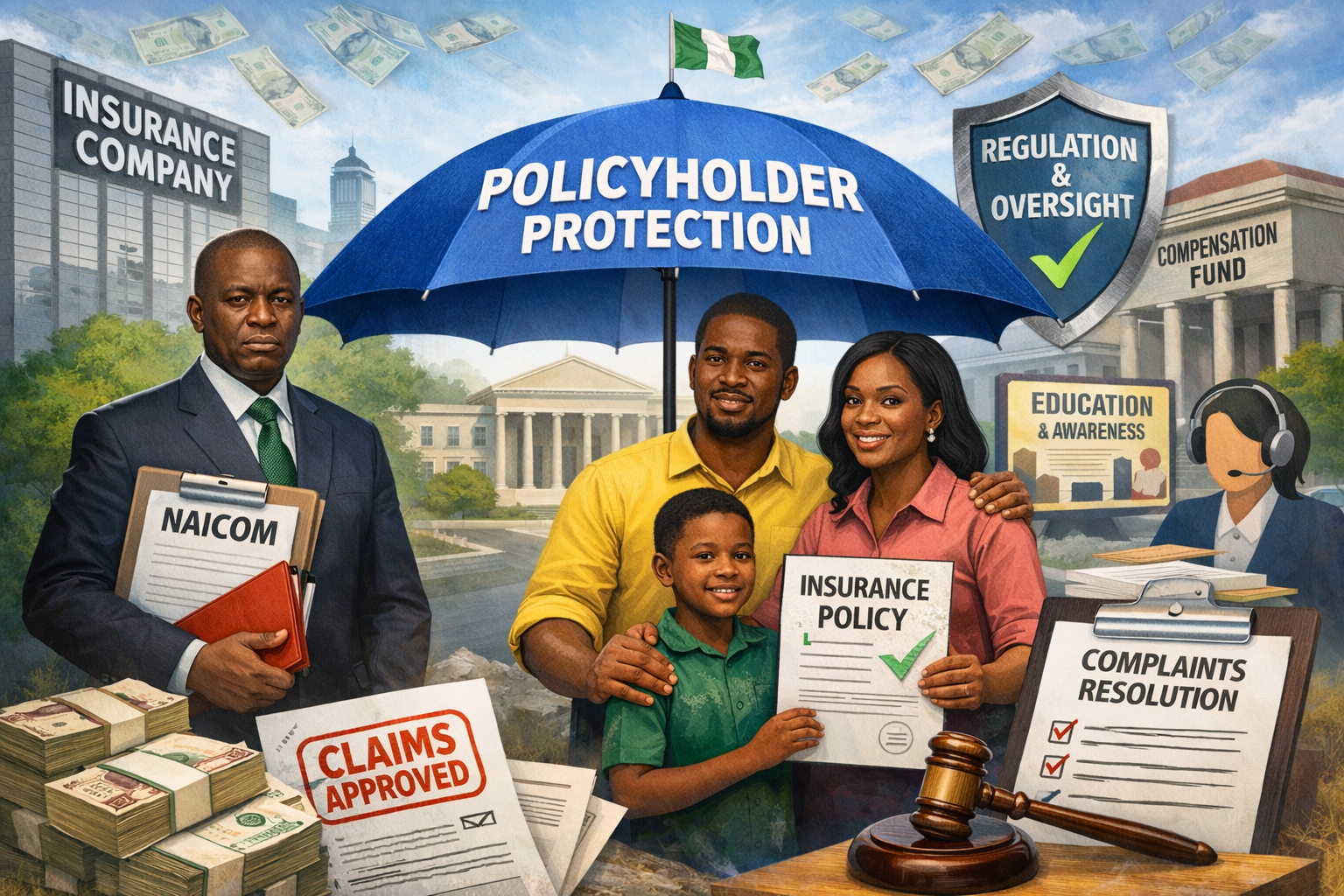

As insurance penetration grows and more Nigerians rely on insurance for financial security, government authorities have stepped up efforts to protect policyholders and strengthen confidence in the industry. Through regulation, supervision and safety-net mechanisms, government plays a central role in ensuring that insurers meet their obligations and that policyholders are not left exposed.

At the heart of policyholder protection is effective regulation. In Nigeria, the National Insurance Commission (NAICOM), backed by enabling laws from the Federal Government, oversees the operations of insurance companies to ensure they remain solvent, compliant and capable of paying claims.

NAICOM sets minimum capital requirements, approves new products, monitors financial health and enforces market conduct rules. These measures are designed to prevent weak or poorly managed insurers from operating and to reduce the risk of company failure that could harm policyholders.

Regulators also issue guidelines on claims settlement timelines, underwriting standards and the treatment of customers, helping to curb sharp practices and unfair dealings.

One of the most direct ways government protects policyholders is by insisting that insurers maintain adequate capital. Capital acts as a financial buffer, ensuring companies can absorb losses and still meet their claims obligations.

Through recapitalisation policies and ongoing solvency monitoring, government seeks to build a stronger and more resilient insurance sector. Well-capitalised insurers are better positioned to honour claims, even during periods of economic stress or large loss events.

To further protect consumers, governments establish compensation mechanisms to cushion policyholders in the event of insurer failure. In Nigeria, provisions exist for policyholder protection through industry-wide arrangements designed to provide relief if a licensed insurer becomes insolvent.

While such frameworks do not eliminate risk entirely, they serve as an important safety net and reinforce trust in the insurance system.

Government protection goes beyond rules on paper. Regulators are empowered to sanction insurers and intermediaries that violate regulations, delay claims unnecessarily, mis-sell products or breach ethical standards.

Penalties may include fines, suspension of licences, management changes or, in extreme cases, liquidation. These enforcement actions are intended to deter misconduct and signal that policyholder interests are taken seriously.

Another key area of government intervention is consumer education. Through public awareness campaigns, stakeholder engagements and collaboration with industry bodies, regulators encourage policyholders to understand their rights and responsibilities under insurance contracts.

Better-informed consumers are less vulnerable to mis-selling and more confident in seeking redress when disputes arise.

Government also provides channels for complaints and dispute resolution. Policyholders who feel unfairly treated can escalate complaints to regulators when internal resolution mechanisms fail. This oversight helps ensure that insurers address grievances promptly and fairly.

While significant progress has been made, challenges remain. Delayed claims, low insurance literacy and limited enforcement capacity continue to affect public perception. However, sustained government commitment to regulation, supervision and consumer protection remains critical to building a stable and trustworthy insurance industry.

For policyholders, government involvement provides an added layer of assurance that insurance is not just a promise on paper, but a regulated financial safeguard backed by law.