Why Nigeria needs national insurance product gift card

Kindly leave a comment and share

Chuks Udo Okonta

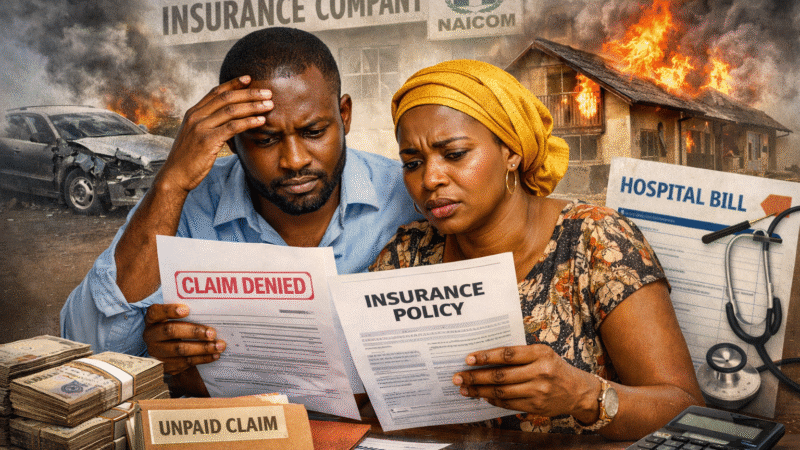

As Nigeria’s insurance industry battles low penetration and limited public trust, stakeholders have called for innovative distribution channels capable of bringing insurance closer to the everyday Nigerian. One such innovation gaining attention is the introduction of a National Insurance Product Gift Card—a prepaid card that can be used to purchase insurance products from multiple licensed insurance companies.

Industry analysts say the concept, if properly designed and regulated, could significantly deepen insurance penetration, especially among first-time buyers and low-income earners.

Nigeria’s insurance penetration remains below one per cent, far behind peer economies in Africa. A major challenge has been access—many Nigerians see insurance as complex, distant and reserved for the elite.

A national insurance gift card would simplify access by allowing individuals to buy insurance the same way they purchase airtime or gift vouchers. The card could be sold in banks, supermarkets, fuel stations, online platforms and mobile money outlets, making insurance more visible and convenient.

“With a gift card, insurance stops being abstract. It becomes something you can hold, gift and use instantly,” an industry expert noted.

The proposed card could support microinsurance, allowing users to redeem small values for health, personal accident, motor third-party, travel or life insurance covers.

Experts believe this aligns with the National Insurance Commission’s (NAICOM) drive for inclusive insurance and digital distribution. A single card usable across multiple insurers would also prevent market dominance and promote healthy competition.

Public mistrust remains a major hurdle for insurance growth. A nationally recognised, regulator-approved gift card could help restore confidence, especially if backed by clear product information, transparent pricing and instant policy issuance.

By partnering with licensed insurers only, the card system would reduce the risk of fake policies, a persistent problem in the Nigerian market.

Beyond individuals, the insurance gift card presents opportunities for corporate gifting, employee welfare schemes and customer reward programmes. Employers could gift staff insurance covers, while companies could use the cards for promotions, loyalty rewards or social responsibility initiatives.

Retail adoption could also drive insurance awareness organically, as cards displayed at sales points would stimulate curiosity and conversations about insurance.

For successful implementation, stakeholders say strong collaboration among NAICOM, insurers, fintech firms and payment service providers will be critical. The platform would require secure technology for verification, redemption and data protection, as well as clear regulatory guidelines on fund management and claims obligations.

As Nigeria pushes for financial inclusion and digital transformation, the national insurance product gift card represents a practical step towards demystifying insurance and embedding it into everyday life.

Analysts conclude that with the right regulatory support and industry collaboration, the initiative could become a game-changer—turning insurance from a “distress purchase” into a gift of protection accessible to all Nigerians.