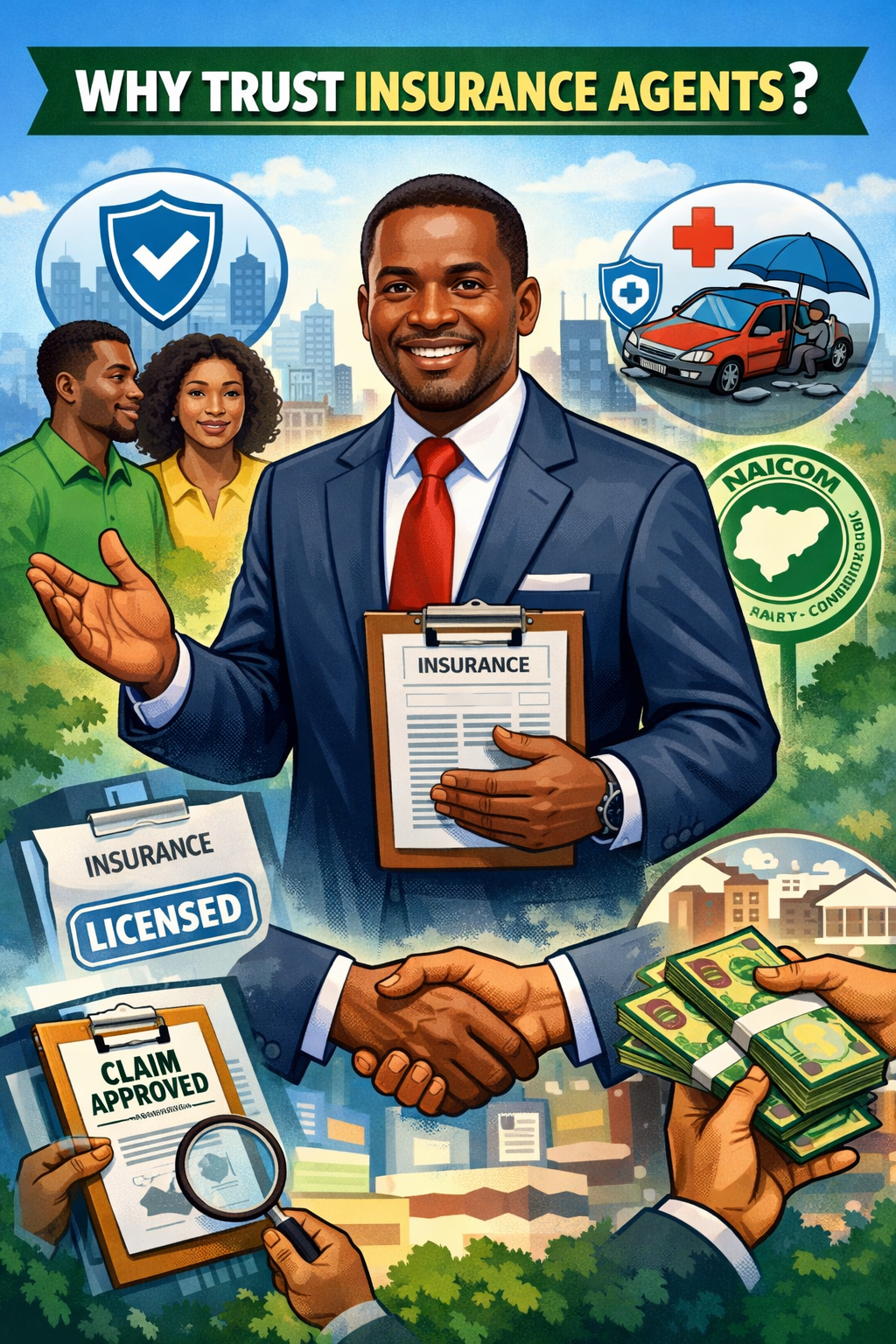

Why should I trust insurance agents?

Kindly leave a comment and share

Blessing chuks Okonta

Trust remains one of the biggest challenges facing Nigeria’s insurance industry. Despite regulatory reforms and increasing public awareness, many Nigerians still approach insurance with caution, often questioning the role and reliability of insurance agents. Yet, insurance agents remain a critical link between insurers and policyholders.

Insurance agents serve as the primary interface between insurance companies and the public. They help prospective policyholders understand policy terms, coverage limits, exclusions and premium obligations, translating technical insurance language into information that consumers can easily grasp.

By assessing individual and business risks, agents guide clients toward insurance products that align with their specific needs rather than generic offerings.

In Nigeria, insurance agents operate within a regulated environment overseen by the National Insurance Commission (NAICOM). Licensed agents are required to meet set professional and ethical standards and are attached to registered insurance companies.

This regulatory structure is designed to safeguard policyholders and reduce the incidence of fake policies and unethical sales practices in the market.

Insurance agents are not only sales intermediaries; they also play an important role in policy servicing. From policy renewals and endorsements to claims notification and documentation, agents provide ongoing support throughout the policy lifecycle.

During claims, agents often act as facilitators, helping policyholders navigate procedures that may otherwise appear complex or discouraging.

Unlike digital platforms where interactions may be impersonal, insurance agents build direct relationships with clients. This proximity creates accountability, as agents are accessible and can be held responsible for the guidance they provide.

Reputation, referrals and long-term client relationships are vital to an agent’s success, reinforcing the importance of professionalism and transparency.

Industry observers note that while cases of misconduct exist, they do not define the entire profession. Policyholders are advised to verify agent credentials, request official documentation and ensure that premium payments are made directly to insurance companies.

These steps help customers identify genuine agents and avoid fraudulent operators.

As the industry works to deepen insurance penetration, restoring public confidence remains a priority. Insurance agents, when properly trained and ethically driven, play a strategic role in educating the public and promoting the value of insurance as a financial protection tool.

Ultimately, trust in insurance agents is built through transparency, competence and consistent service delivery — principles that are essential to the growth and credibility of Nigeria’s insurance market.