Will Insurance really pay when you need it? Nigerians question reality behind insurers promises

Kindly leave a comment and share

Blessing chuks Okonta

For many Nigerians, insurance is marketed as a financial lifeline — a guarantee that when accidents, illness, fire, or loss strikes, relief will follow. Yet across the country, a lingering doubt persists: will insurance actually pay when it matters most?

Despite decades of awareness campaigns by insurers and regulators, public trust in insurance remains fragile. Stories of delayed claims, unpaid benefits, and complicated processes have fueled skepticism, leaving many to see insurance not as protection, but as a gamble.

Insurance penetration in Nigeria remains below one per cent, one of the lowest globally. Industry experts say distrust is a major reason.

“People believe insurance companies collect premiums easily but disappear when claims arise,” said a Lagos-based financial analyst. “Even when claims are eventually paid, delays create the impression that insurers are unwilling to honour their obligations.”

While insurance companies insist that most valid claims are settled, consumers often recall the exceptions — the cases that go wrong — more vividly than the successes.

Insurance operators point to several factors that commonly lead to claim disputes:

Non-disclosure of material facts: Failure to fully disclose information when purchasing a policy can invalidate claims.

Policy exclusions: Many losses are not covered unless specifically stated in the policy.

Late notification: Claims reported outside the stipulated time frame may be rejected.

Incomplete documentation: Missing reports, receipts, or evidence can stall or cancel claims.

According to the National Insurance Commission (NAICOM), a significant number of denied claims result from policyholders not understanding the terms of their contracts.

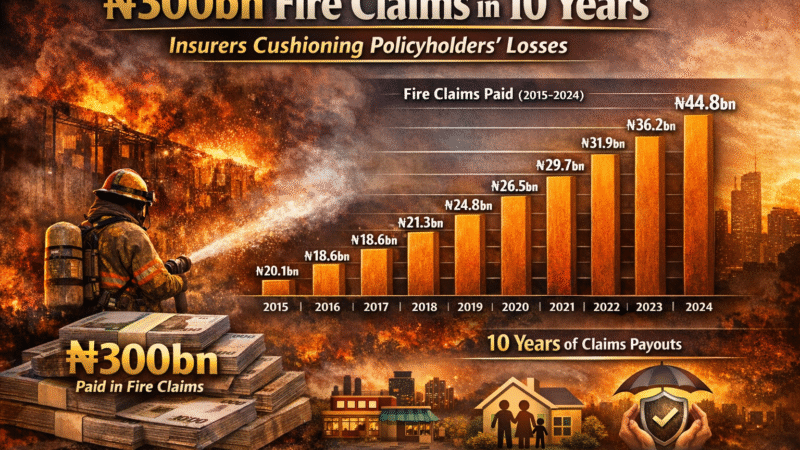

Insurance companies argue that they are unfairly portrayed. The Nigerian Insurers Association (NIA) maintains that the industry pays billions of naira in claims annually, particularly in motor, fire, and group life insurance.

“Insurance works when both parties uphold their responsibilities,” an industry spokesperson said. “We encourage policyholders to read their policies, ask questions, and engage licensed professionals.”

NAICOM has also introduced reforms aimed at strengthening consumer protection, including sanctions for defaulting insurers and digital platforms for lodging complaints.

Experts advise Nigerians to take a proactive approach to insurance by:

Buying policies from licensed insurers

Understanding coverage limits and exclusions

Keeping copies of policy documents and receipts

Reporting incidents promptly

Escalating unresolved claims to regulators

Financial literacy advocates stress that insurance should be treated as a legal contract, not a goodwill arrangement.

Insurance remains a vital tool for economic stability, but until transparency improves and claims processes become faster and simpler, public skepticism is unlikely to fade.

For now, the question many Nigerians continue to ask is not whether insurance exists — but whether it will truly stand by them when the unexpected happens.