PFAs struggle with Personal Pension Plan as only 15,677 accounts out of 206,917 are funded

Kindly leave a comment and share

Chuks Udo Okonta

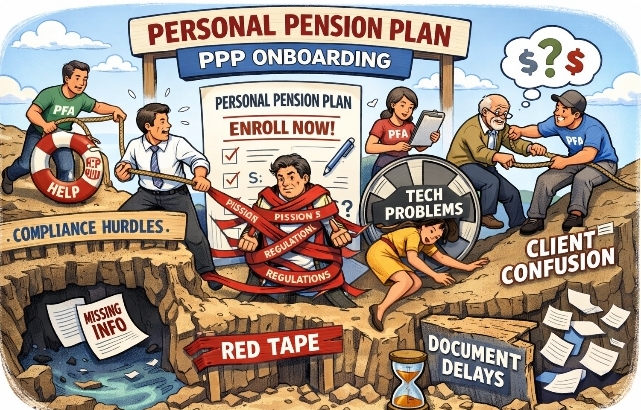

Pension Fund Administrators (PFAs) are really struggling with the Personal Pension Plan (PPP) operations as out of the 206,917 Retirement Savings Accounts (RSAs) registered only 15,677 which is 7.6 per cent were funded, while 191,240 92.4 per cent remained unfunded.

According to the National Pension Commission (PenCom) as at 30 September 2025, a total of 206,917 RSAs were registered under the Personal Pension Plan (PPP), of which 15,677 (7.6 per cent) were funded during the quarter, while 191,240 (92.4 per cent) remained unfunded. This highlights a persistent challenge in contribution remittance, despite growth in total RSA registrations, PenCom added.

It noted that a further review of registration data shows that although 215,914 RSA PINs have been issued by PFAs since the inception of the PPP, only 206,917 remained subsisting as at the end of Q3 2025. The difference reflects accounts that were either converted to the mandatory Contributory Pension Scheme (CPS) following contributors’ transition into formal employment or deactivated due to invalid PINs.

“A closer look at the data reveals significant disparities among Pension Fund Administrators (PFAs) in the proportion of funded accounts. AccessARM, which holds the largest share of PPP RSAs (107,547 accounts), had only 2,129 funded RSAs, representing just two per cent of its total accounts funded, indicating a large pool of dormant accounts.

“Similarly, Stanbic IBTC recorded 33,340 unfunded accounts, accounting for 92 per cent of its total RSAs. Other PFAs with particularly high proportions of unfunded accounts include Guarantee Trust Pensions (96%), NLPC PFA (95%), and Trustfund Pensions (94 per cent).

“Conversely, a few PFAs show relatively strong contribution activity. Fidelity Pension Managers, for example, had 1,667 funded RSAs out of 1,887 total accounts, meaning only 12 per cent remained unfunded, reflecting higher engagement of contributors with their accounts. FCMB Pensions and Veritas Glanvills also recorded comparatively lower unfunded ratios of 69 per cent and 71 per cent respectively,” PenCom stated.

The pension industry regulator maintained that overall, the data underscores a critical challenge for the PPP: while registration numbers are increasing, the majority of accounts remain unfunded, limiting the growth of accumulated pension assets. This indicates the need for targeted strategies to drive regular contributions, such as improved participant education, incentive structures, and streamlined remittance processes, to ensure the long- term sustainability and effectiveness of the PPP, it posited.